Current News on e.l.f. Beauty (ELF) Stock: A Significant Decline

In recent days, e.l.f. Beauty Inc. (NYSE: ELF) has been in the spotlight due to a dramatic decline in its stock price. The company, known for its affordable cosmetics, has faced challenges that have led to a significant drop in investor confidence. This article will delve into the latest developments surrounding e.l.f. Beauty's stock, the reasons behind the decline, and the implications for investors.

Stock Performance Overview

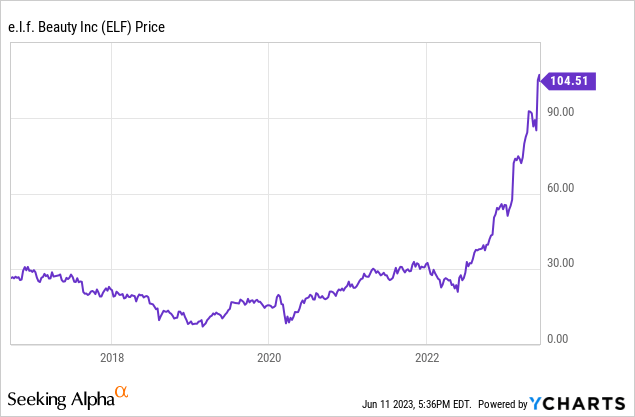

As of February 7, 2025, e.l.f. Beauty's stock has experienced a nearly 25% plunge in after-hours trading. This sharp decline follows the company's announcement of a revised revenue outlook, which disappointed investors. The stock had previously reached a high of $221.83 in 2024, but recent forecasts have led to a significant downturn, with shares trading around $93.44.

Key Articles and Reports

Fast Company reported that e.l.f. Beauty's stock price tumbled after the company warned of weaker demand in 2025. The cosmetics brand had posted strong Q3 revenue results, surpassing analyst expectations with a 31.1% year-over-year increase to $355 million. However, the outlook for the upcoming year has raised concerns among investors.

Business Insider highlighted that the company's stock plunged nearly 25% in after-hours trading due to a slashed revenue outlook. The retailer now projects full-year sales to be significantly lower than previously anticipated.

Investopedia noted that e.l.f. Beauty shares are sinking in premarket trading after the company lowered its outlook for the fiscal year, citing soft sales in January.

Morningstar reported that the decline in e.l.f. Beauty's stock was attributed to softer-than-expected trends in January, which executives believe are linked to broader economic concerns.

Yahoo Finance provided insights into the company's third-quarter revenue, which exceeded expectations, but the subsequent lowering of guidance has led to a 26% drop in stock value.

Reasons Behind the Decline

The decline in e.l.f. Beauty's stock can be attributed to several factors:

1. Lowered Revenue Outlook

The most significant factor contributing to the stock's decline is the company's revised revenue outlook. e.l.f. Beauty has indicated that it expects full-year sales to be lower than previously forecasted, which has raised concerns about the company's growth trajectory.

2. Consumer Behavior Changes

e.l.f. Beauty's CEO, Tarang Amin, pointed out that consumer spending on cosmetics has been affected by external factors, including economic uncertainty and distractions from social media platforms like TikTok. The CEO noted that consumers were more focused on current events, such as the LA wildfires, which may have impacted their purchasing decisions.

3. Market Trends

The broader market trends in the cosmetics industry have also played a role. The company has reported sluggish demand in the mass beauty segment, particularly at the start of the year. This trend has prompted analysts to adjust their ratings and price targets for e.l.f. Beauty.

4. Analyst Reactions

Following the earnings report, several analysts have lowered their price targets for e.l.f. Beauty. For instance, B. Riley reduced its price target from $150 to $90, maintaining a Buy rating on the shares. This reflects a cautious outlook on the company's ability to recover from the current downturn.

Implications for Investors

The recent developments surrounding e.l.f. Beauty's stock present both challenges and opportunities for investors:

1. Short-Term Volatility

Investors should be prepared for short-term volatility as the market reacts to the company's revised outlook and broader economic conditions. The significant drop in stock price may present a buying opportunity for those who believe in the long-term potential of the brand.

2. Long-Term Growth Potential

Despite the current challenges, e.l.f. Beauty has demonstrated strong revenue growth in the past. The company's ability to adapt to changing consumer preferences and market conditions will be crucial for its long-term success.

3. Monitoring Market Trends

Investors should closely monitor market trends and consumer behavior in the cosmetics industry. Understanding the factors influencing consumer spending will be essential for making informed investment decisions.

The recent decline in e.l.f. Beauty's stock serves as a reminder of the volatility inherent in the stock market, particularly in the consumer goods sector. While the company's revised revenue outlook has raised concerns, its past performance and brand strength suggest that there may still be potential for recovery. Investors should weigh the risks and opportunities carefully as they navigate this challenging landscape.

For more detailed updates and analysis, you can follow the latest news on e.l.f. Beauty's stock through various financial news platforms, including Yahoo Finance, Business Insider, and Investopedia.