Current News on IRAs: Key Updates and Changes

The landscape of Individual Retirement Accounts (IRAs) is undergoing significant changes, particularly with the implementation of the SECURE Act 2.0 and various updates from the IRS. This article summarizes the latest developments, including new rules, tax implications, and important deadlines that individuals should be aware of as they plan for their retirement.

Overview of Recent Changes

SECURE Act 2.0

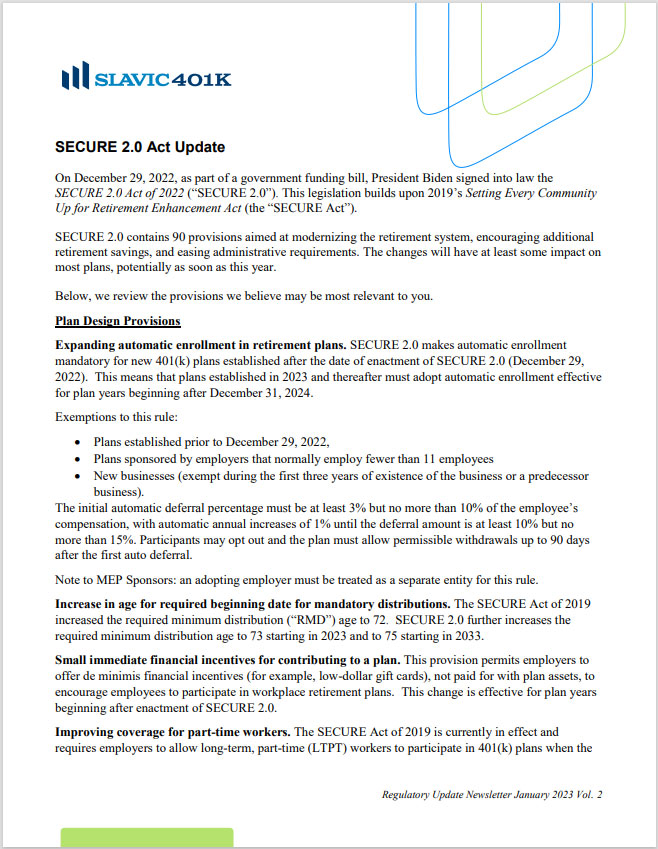

The SECURE Act 2.0, which builds upon the original SECURE Act passed in 2019, introduces several important updates to retirement planning, particularly concerning IRAs. Key changes include:

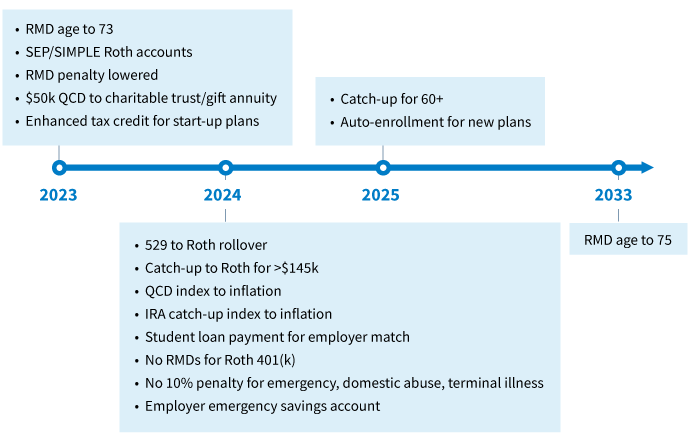

- Required Minimum Distributions (RMDs): The age for starting RMDs has been adjusted, allowing individuals to keep their funds invested for a longer period. Under the new rules, individuals must begin taking RMDs at age 73 instead of 72.

- Catch-Up Contributions: For those aged 50 and older, the catch-up contribution limit has been increased, allowing for greater savings as retirement approaches.

- Roth IRAs: New provisions allow for Roth IRA contributions to be made regardless of income levels, making this option more accessible to high earners.

For a detailed overview of these changes, you can refer to the article from the National Law Review published on December 9, 2024. It discusses the implications of these updates on retirement planning and tax strategies. Read more here.

Tax Changes and Implications

Recent articles from Forbes and the IRS highlight the tax implications of these changes. For instance, the annual contribution limit for IRAs remains at $7,000, with a catch-up contribution limit of $1,000 for those aged 50 and over. This means that individuals can contribute a total of $8,000 if they qualify for catch-up contributions.

Additionally, the IRS has clarified that the 401(k) contribution limit will increase to $23,500 for 2025, while the IRA limit will remain unchanged. This distinction is crucial for individuals looking to maximize their retirement savings.

Executive Orders and IRA Funds

In a political context, the White House has recently narrowed an executive order that restricts the disbursement of funds related to the Inflation Reduction Act (IRA). This move has implications for how IRA funds can be utilized, particularly in the energy sector. The guidance issued by the Office of Management and Budget (OMB) aims to clarify the limits on these funds, which were ordered by President Trump. For more details, check out the article from The Hill published on January 22, 2025. Read more here.

Key Articles and Resources

6 New Retirement Rules and Tax Changes Everyone Should Know - This article from Forbes discusses the implications of the new rules on retirement planning. Read more here.

401(k) Limit Increases to $23,500 for 2025, IRA Limit Remains $7,000 - The IRS provides updates on contribution limits for retirement accounts. Read more here.

Treasury, IRS Issue Updated Guidance on Required Minimum Distributions - This article outlines the final regulations regarding RMDs and their impact on IRA owners. Read more here.

What to Know About Changes to IRA Required Minimum Distributions - U.S. News provides insights into the new RMD rules and their implications for beneficiaries. Read more here.

4 Reasons the Roth IRA Might be the Most Powerful Retirement Account of All Time - This article from 24/7 Wall St discusses the benefits of Roth IRAs in retirement planning. Read more here.

As the rules surrounding IRAs evolve, it is essential for individuals to stay informed about the latest changes and how they may affect their retirement planning strategies. The SECURE Act 2.0 and updates from the IRS provide new opportunities for maximizing retirement savings, but they also require careful consideration of tax implications and compliance with new regulations.

For those looking to optimize their retirement accounts, consulting with a financial advisor or tax professional is advisable to navigate these changes effectively. Keeping abreast of the latest news and updates will ensure that individuals can make informed decisions about their financial futures.