Current News on Robinhood Markets, Inc. (HOOD) Stock

As of February 2025, Robinhood Markets, Inc. (HOOD) has been making headlines in the financial world, particularly as it approaches its fourth-quarter earnings report. The stock has shown significant movement, with analysts and investors closely monitoring its performance. Below is a comprehensive overview of the latest news, stock performance, and key financial metrics related to Robinhood.

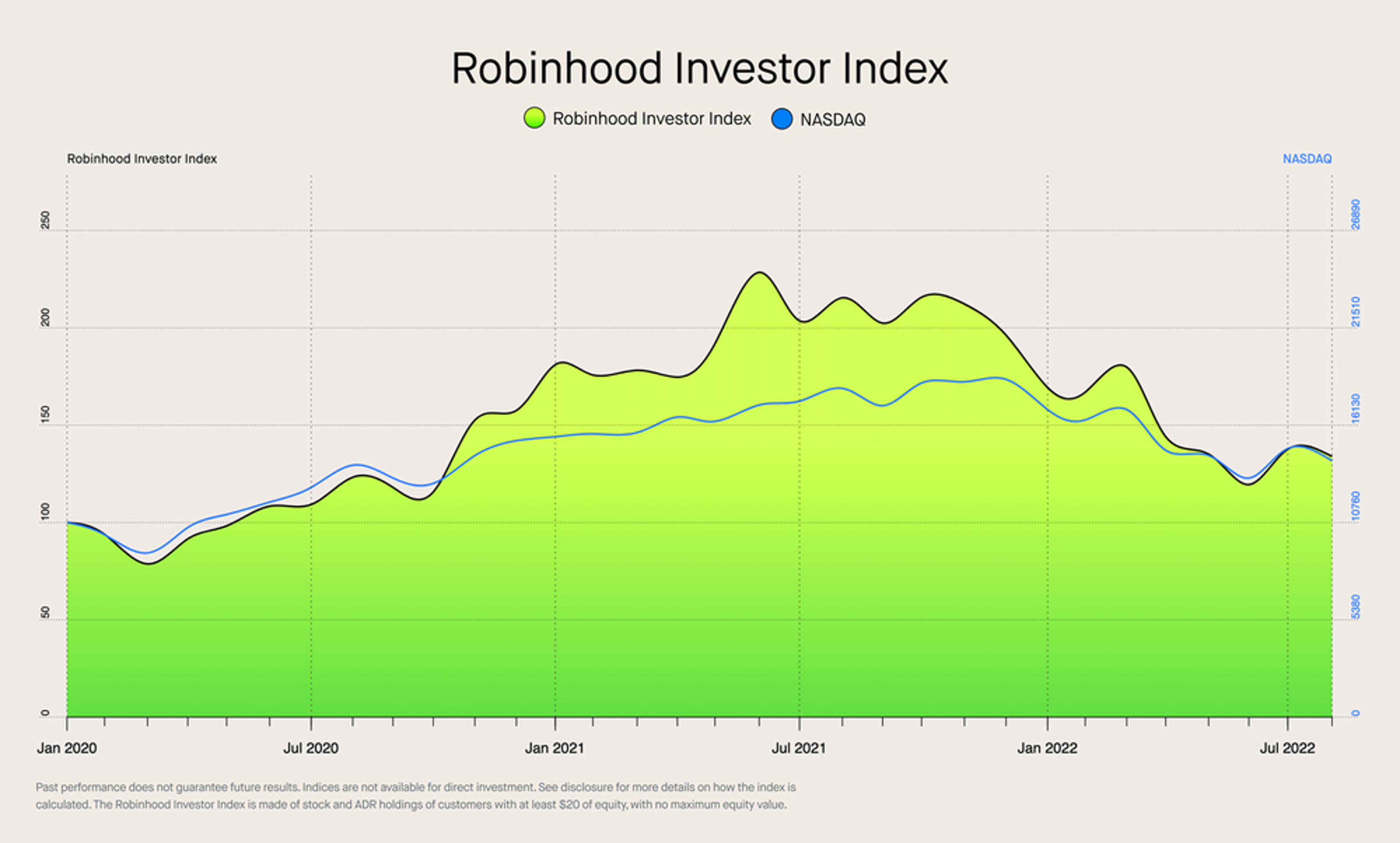

Recent Stock Performance

Stock Surge Ahead of Earnings

On February 12, 2025, Robinhood's stock surged by more than 5% in anticipation of its fourth-quarter earnings report. Analysts are optimistic, predicting that the company will report earnings of $0. This surge reflects growing confidence among investors, particularly as Wall Street anticipates a doubling of revenue for the company.

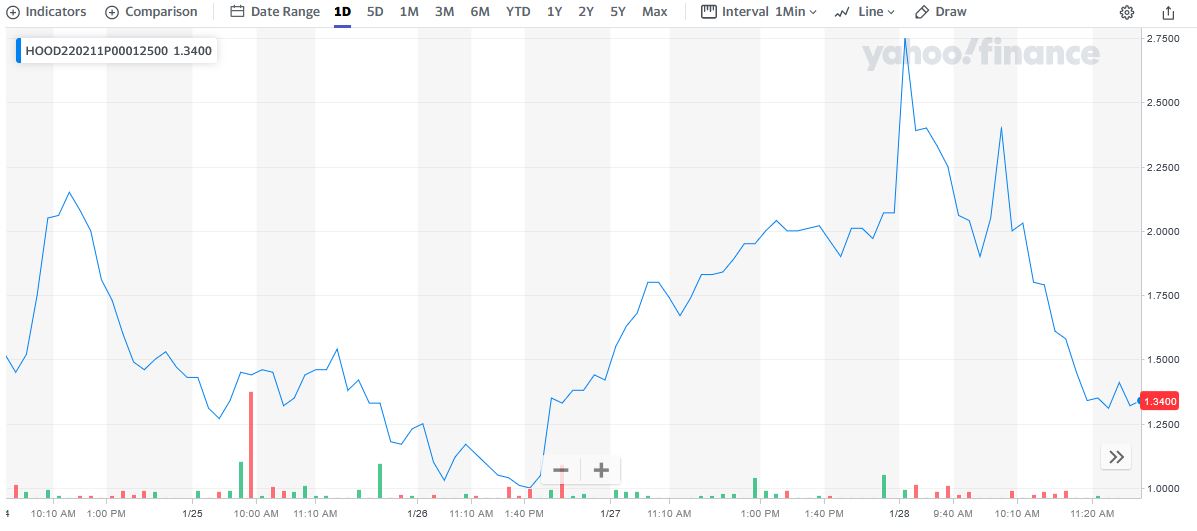

Strong Q4 Results

In a recent report, Robinhood announced that its Q4 sales increased by 115% year-on-year, reaching $1.01 billion. The company's GAAP profit was reported at $1.01 per share, significantly exceeding analysts' expectations. This strong performance has led to a notable increase in stock value, with shares gapping up by 11% in after-hours trading following the earnings announcement.

Analyst Ratings and Forecasts

According to a recent analysis, the average rating for HOOD stock is a "Buy" from 17 analysts. The 12-month stock price forecast is set at $44.63, indicating a potential decrease of 20.69% from the latest price. Despite this forecast, the overall sentiment remains positive, especially following the recent earnings report.

Key Financial Metrics

- Market Capitalization: $43.67 billion

- Net Income (ttm): $525 million

- Revenue (ttm): $2.41 billion

- Shares Outstanding: 883.98 million

These metrics highlight Robinhood's robust financial standing, which is crucial for investors looking to make informed decisions.

Latest News Articles

Robinhood Stock Nears All-Time High

Read more

Published: February 12, 2025

Description: Robinhood's stock is nearing an all-time high as Wall Street anticipates a doubling of revenue and retail investors bet on a strong Q4 earnings report.Robinhood Reports Strong Q4, Stock Soars

Read more

Published: February 12, 2025

Description: The financial services company reported a significant increase in sales and profits, leading to a surge in stock prices.HOOD Earnings: Robinhood Smashes Q4 Estimates

Read more

Published: February 12, 2025

Description: Shares of Robinhood gained in after-hours trading after the company reported earnings that exceeded expectations.Robinhood Stock Drives Up After Q4 Earnings Blow Past Consensus

Read more

Published: February 12, 2025

Description: Following a strong earnings report, Robinhood's stock saw a significant increase, reflecting investor confidence.Is Robinhood (HOOD) a Good Stock to Buy Before Earnings?

Read more

Published: February 10, 2025

Description: As investors await the Q4 earnings results, shares of Robinhood have been on the rise, prompting discussions about its potential as a buy.

The recent performance of Robinhood Markets, Inc. (HOOD) stock has captured the attention of investors and analysts alike. With a strong earnings report and positive forecasts, the company appears to be on a solid trajectory. As always, potential investors should conduct thorough research and consider market conditions before making investment decisions. For ongoing updates, you can follow the latest news on platforms like Yahoo Finance, MarketWatch, and Business Insider.

For more detailed information, you can visit the following resources:

Stay informed and make educated investment choices!