Current Trends in Homeowners Insurance: A Comprehensive Overview

As homeowners across the United States grapple with rising insurance premiums and changing coverage options, the landscape of homeowners insurance is undergoing significant transformations. This article delves into the latest news, trends, and insights affecting homeowners insurance, highlighting the challenges and developments that are shaping the industry.

Rising Premiums and Shrinking Coverage

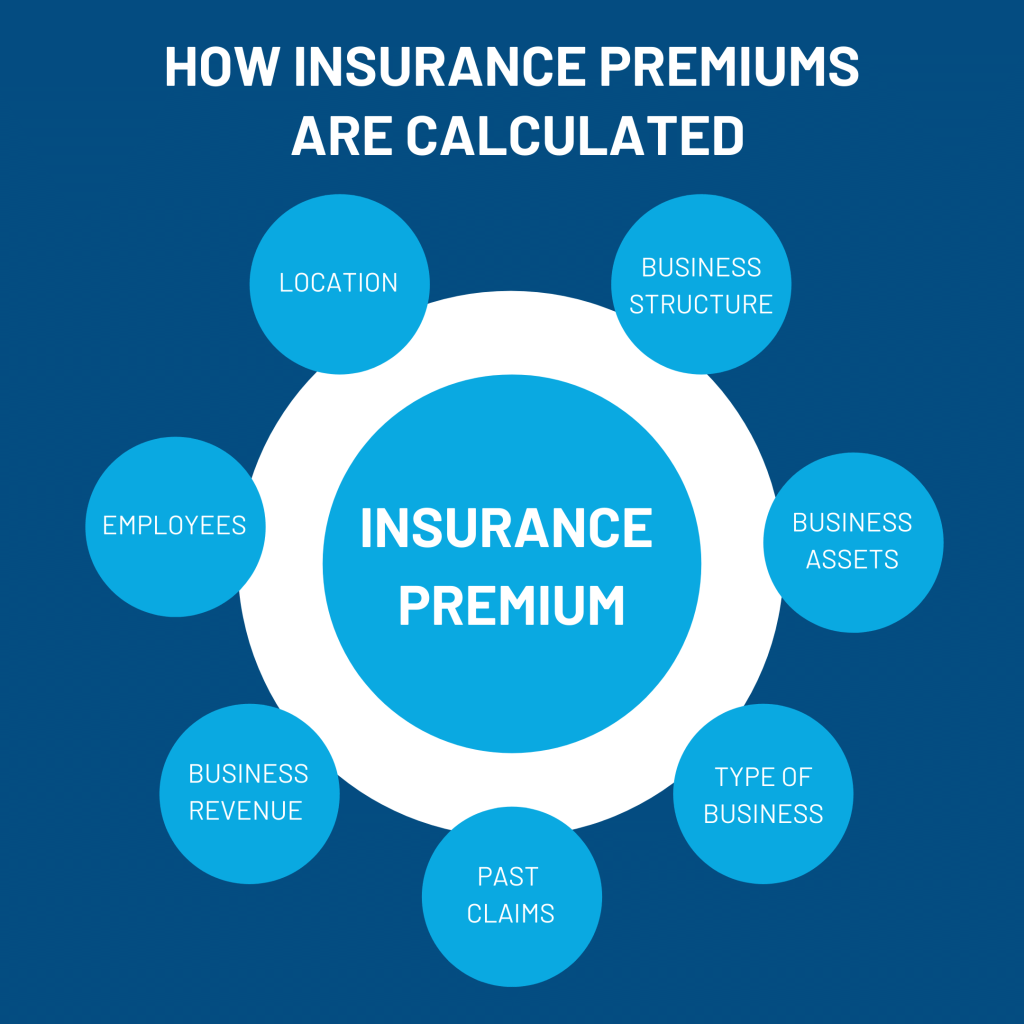

One of the most pressing issues facing homeowners today is the sharp increase in insurance premiums. According to recent reports, homeowners insurance premiums have risen by an alarming 34% nationwide between 2017 and 2023. This trend is largely attributed to various factors, including climate change, which has led to more frequent and severe weather events, thereby increasing the risk for insurers.

Climate Change Impact

A significant report from the Insurance Journal emphasizes that climate change is a major driver behind the rising costs of homeowners insurance. As extreme weather events become more common, insurers are forced to adjust their pricing models to account for the increased risk. This has resulted in many homeowners facing higher premiums and, in some cases, reduced coverage options. For instance, in areas prone to wildfires or hurricanes, securing adequate insurance has become increasingly difficult.

Regional Variations

The U.S. Department of the Treasury has noted that homeowners insurance costs are rising at different rates across the country, with some regions experiencing more significant increases than others. For example, states like Florida and California are particularly hard-hit, with many homeowners struggling to find affordable coverage. In fact, Florida has been identified as one of the hardest places in the U.S. to obtain homeowners insurance, with many insurers pulling out of the market altogether.

The Struggles of Homeowners

The challenges faced by homeowners are not just limited to rising costs. Many families, particularly in high-risk areas, have found themselves dropped by their insurance companies. A recent report from CBS News highlighted that over 100,000 homeowners in the Los Angeles area were dropped by their insurers just before the recent wildfires, leaving them vulnerable and without coverage.

Underinsurance Concerns

Another critical issue is the potential for underinsurance. The Consumer Financial Protection Bureau (CFPB) has found that many properties, especially in non-coastal flood zones, may be underinsured. This poses a significant risk for homeowners who may not have adequate coverage to rebuild or recover from disasters.

Recent Developments in Homeowners Insurance

Rate Increases

Several states have announced upcoming rate increases for homeowners insurance. For instance, the North Carolina Department of Insurance recently revealed that the average statewide rate for homeowners insurance will increase by 7.5% starting June 1, 2025. This increase is attributed to inflation and the ongoing impacts of climate change.

In Illinois, Allstate has filed for a 14.3% rate increase, affecting nearly 248,000 customers. Such increases are becoming commonplace as insurers adjust to the evolving risk landscape.

Coverage Options

As the market shifts, homeowners are encouraged to explore various coverage options. For those who have been denied coverage, resources are available to help navigate the complexities of obtaining homeowners insurance. Articles from MSN provide guidance on how to secure the necessary coverage, especially for those living in high-risk areas.

Insights from Industry Experts

Industry experts are voicing concerns about the sustainability of the homeowners insurance market. The CNN report on the crumbling home insurance market in New Orleans illustrates the dire situation many homeowners face. With skyrocketing premiums and limited options, homeowners are left with few choices, often leading to financial strain.

The Role of Insurers

Insurers are also feeling the pressure. The Best’s Special Report indicates that the direct incurred loss ratios for homeowners insurance have improved year over year, but the challenges remain significant. Insurers must balance the need to remain profitable while providing adequate coverage to homeowners.

The current state of homeowners insurance is marked by rising premiums, shrinking coverage, and regional disparities. Homeowners are urged to stay informed about the latest trends and developments in the industry, as these factors will continue to shape their insurance options. As climate change and economic pressures persist, the landscape of homeowners insurance will likely evolve, necessitating proactive measures from both homeowners and insurers alike.

For more detailed insights and updates, homeowners can refer to resources such as the Insurance Journal, CBS News, and the U.S. Department of the Treasury. Staying informed is crucial in navigating the complexities of homeowners insurance in today's challenging environment.