Bank of Japan's Recent Rate Decision: A Comprehensive Overview

The Bank of Japan (BOJ) has made headlines recently with its decision to raise interest rates, marking a significant shift in its monetary policy. This decision comes after a two-day policy meeting and is seen as a response to the evolving economic landscape in Japan. Below, we delve into the details surrounding this decision, its implications, and the reactions from various stakeholders.

Key Highlights of the BOJ Rate Decision

Interest Rate Increase: The BOJ has raised its short-term interest rate from 0.25% to 0.5%, the highest level in 17 years. This move is part of a broader strategy to combat inflation and stabilize the economy.

Inflation Targeting: The central bank's decision is influenced by recent data indicating that inflation is hovering around the 2% target, which the BOJ has aimed to maintain. The increase in rates is expected to help manage inflationary pressures while supporting wage growth.

Market Reactions: Following the announcement, the Japanese yen gained strength against the U.S. dollar, reflecting investor confidence in the BOJ's decision. The market's response indicates a positive outlook on Japan's economic recovery and the effectiveness of the BOJ's policies.

Future Outlook: BOJ Governor Kazuo Ueda has hinted at the possibility of further rate hikes in the future, depending on economic conditions. This suggests that the BOJ is prepared to take additional measures if inflation continues to rise or if wage growth accelerates.

Detailed Analysis of the Decision

Economic Context

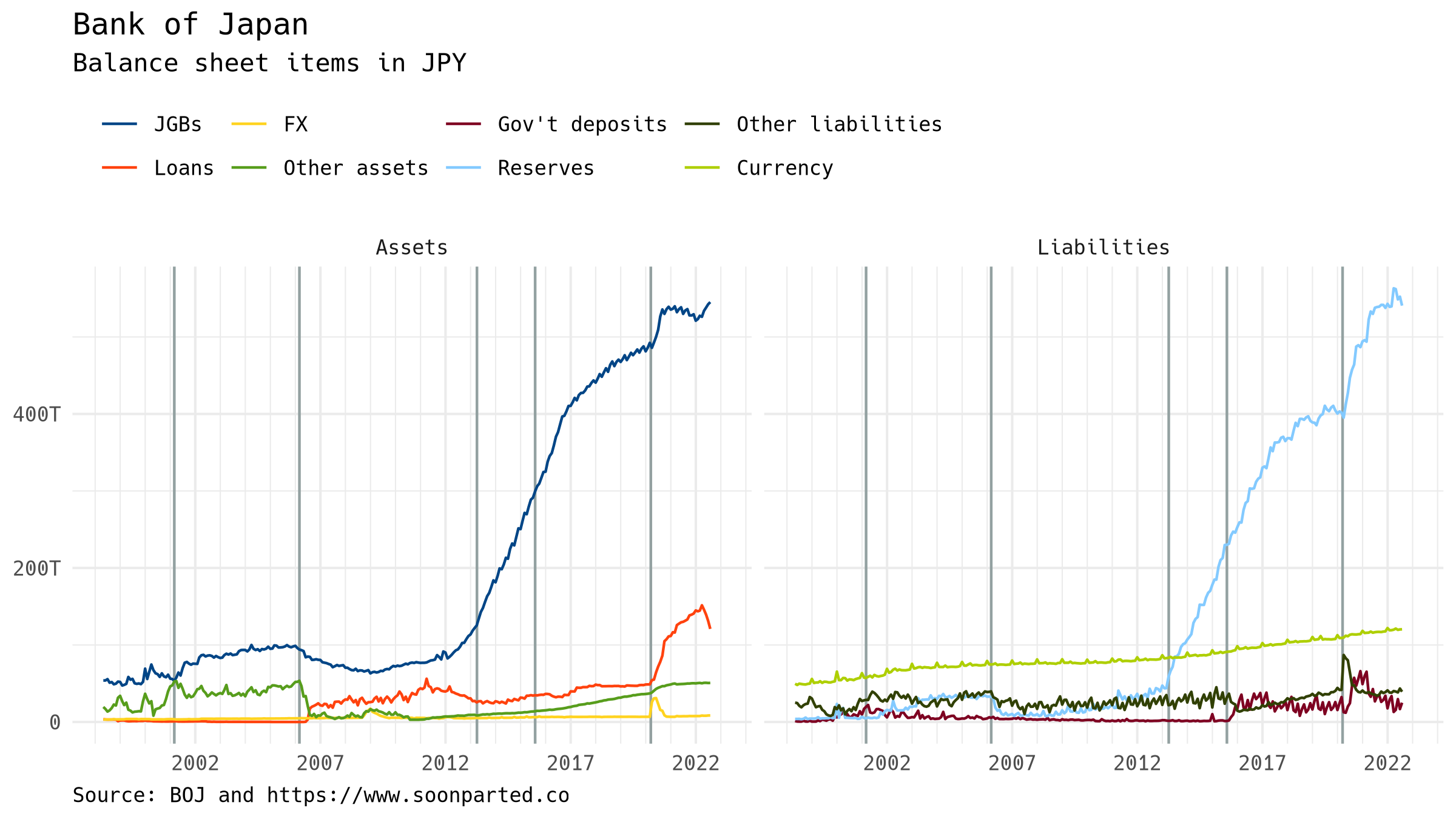

The BOJ's decision to raise interest rates comes after a prolonged period of ultra-low rates aimed at stimulating economic growth. The central bank has faced challenges in achieving its inflation target, which has led to a reevaluation of its monetary policy. The recent increase is seen as a necessary step to transition away from a decade of negative interest rates and to foster a more sustainable economic environment.

Implications for Consumers and Businesses

Borrowing Costs: The increase in interest rates will likely lead to higher borrowing costs for consumers and businesses. This could impact spending and investment decisions, potentially slowing down economic growth in the short term.

Savings Incentives: On the flip side, higher interest rates may encourage savings, as consumers can earn more on their deposits. This could lead to a shift in consumer behavior, with individuals opting to save rather than spend.

Global Economic Impact

The BOJ's decision is not only significant for Japan but also has implications for the global economy. As one of the largest economies in the world, changes in Japan's monetary policy can influence global financial markets, particularly in Asia. Investors will be closely monitoring how this decision affects currency exchange rates and international trade dynamics.

Reactions from Analysts and Economists

Economists have largely welcomed the BOJ's decision, viewing it as a necessary adjustment to changing economic conditions. Many analysts believe that the rate hike reflects the BOJ's confidence in the resilience of the Japanese economy. However, some caution that the central bank must tread carefully to avoid stifling growth.

Statements from BOJ Officials

In a press conference following the announcement, Governor Ueda emphasized the importance of maintaining a balance between controlling inflation and supporting economic growth. He stated, "We are committed to ensuring that our policies adapt to the evolving economic landscape, and we will continue to monitor inflation and wage growth closely."

The BOJ's recent decision to raise interest rates marks a pivotal moment in Japan's economic policy. As the central bank navigates the complexities of inflation and economic recovery, stakeholders across the globe will be watching closely. The implications of this decision will unfold over time, influencing everything from consumer behavior to international financial markets.

For more detailed information, you can read the full articles from Reuters, Bloomberg, and AP News.