Venture Global's Recent IPO: A Comprehensive Overview

In a significant development within the energy sector, Venture Global, a prominent liquefied natural gas (LNG) exporter, has successfully completed its initial public offering (IPO), raising $1.75 billion. This IPO is notable for being the largest in the energy sector in recent years, despite facing challenges that have led to a reduction in its initial valuation expectations.

IPO Details and Market Performance

On January 24, 2025, Venture Global priced its IPO at $25 per share, which is the midpoint of its revised price range of $23 to $27. The company sold 70 million shares, aiming to capitalize on the growing demand for LNG amid a global energy transition. However, the shares opened at $24.05, reflecting a 3.8% drop from the IPO price, indicating a cautious reception from investors.

Financial Performance

In the nine months leading up to September 30, 2024, Venture Global reported a net income of $756 million on revenues of $3.4 billion. This is a decline compared to the same period in 2023, where the company had a net income of $3.6 billion on revenues of $6.3 billion. The recent financial performance highlights the challenges the company faces, including a net loss of $294 million in the most recent quarter, down from a profit of $781 million in the previous year.

Market Context and Investor Sentiment

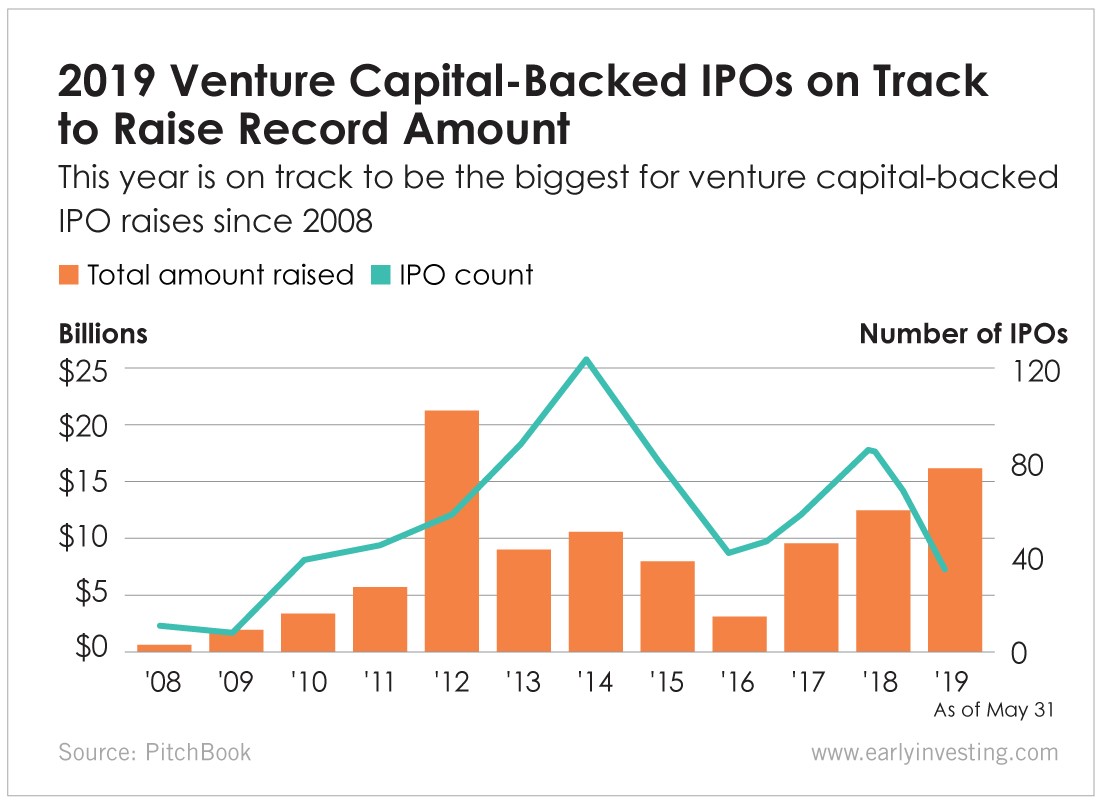

The IPO comes at a time when the IPO market is experiencing a chilly climate, with many investors adopting a cautious approach towards new listings. The Wall Street Journal noted that Venture Global's ambitious goal of raising up to $2.3 billion at a $110 billion valuation was met with skepticism, leading to a significant reduction in expectations.

Valuation Adjustments

Initially, the company aimed for a valuation of $110 billion, but this was adjusted to approximately $58 billion following the IPO. This adjustment reflects the broader market conditions and investor sentiment towards energy stocks, particularly in the context of fluctuating natural gas prices and geopolitical uncertainties.

Strategic Implications for Venture Global

Venture Global's IPO is seen as a pivotal moment for the company, positioning it among the top players in the U.S. LNG market, second only to Cheniere Energy. The funds raised from the IPO are expected to support the company's expansion plans and enhance its competitive edge in the rapidly evolving energy landscape.

Future Prospects

Despite the initial setbacks, analysts suggest that the IPO could signal a shift in energy investing, particularly as the world moves towards cleaner energy sources. The company's strategic focus on LNG, which is considered a transitional fuel, aligns with global efforts to reduce carbon emissions while meeting energy demands.

Venture Global's IPO marks a significant milestone in the energy sector, reflecting both the potential and challenges of the LNG market. As the company navigates the complexities of public trading and investor expectations, its future performance will be closely watched by industry stakeholders and analysts alike. The successful raising of $1.75 billion is a testament to the ongoing interest in LNG as a critical component of the global energy transition, despite the current market volatility.

For more detailed information, you can explore the following articles:

- MarketWatch: LNG exporter Venture Global closes $1.75 billion IPO after cutting share price

- Yahoo Finance: LNG Firm Venture Global Gets $1.75 Billion in Year’s Biggest IPO

- Bloomberg: LNG Exporter Venture Global Shares Open 3.8% Below IPO Price

This IPO not only highlights the resilience of the LNG sector but also sets the stage for future developments in energy investments.