Overview of 2024 Tax Brackets and Adjustments

As we approach the end of 2023, taxpayers are keenly interested in understanding the 2024 tax brackets and the adjustments made by the Internal Revenue Service (IRS). The IRS has officially announced the new tax brackets, standard deductions, and other inflation adjustments that will impact taxpayers for the upcoming tax year. This article provides a comprehensive overview of the changes, their implications, and where to find more detailed information.

Key Changes in 2024 Tax Brackets

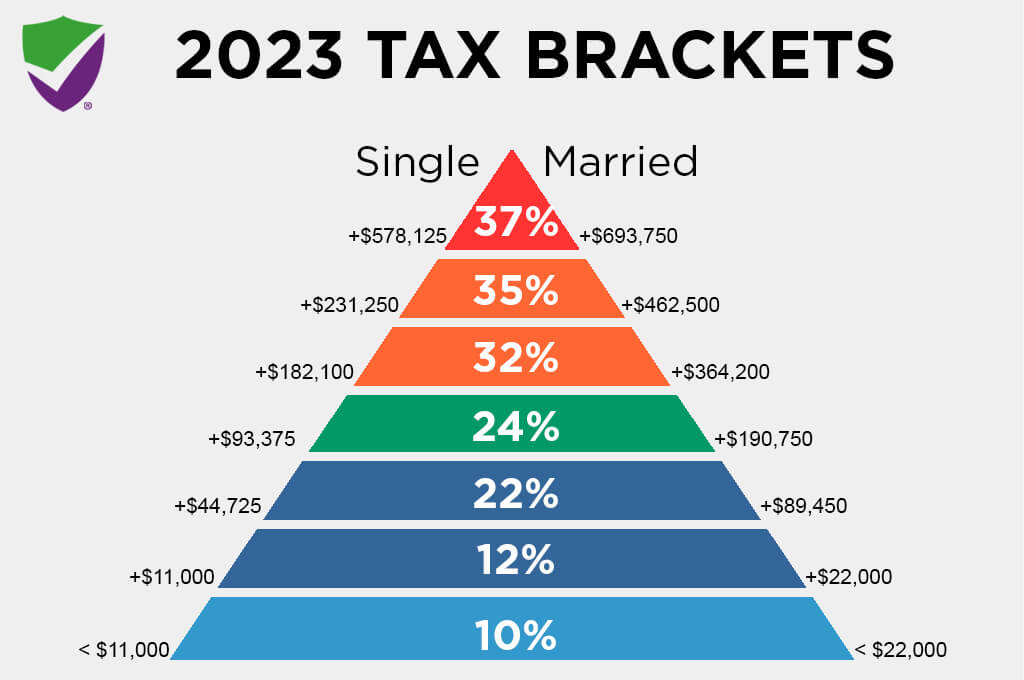

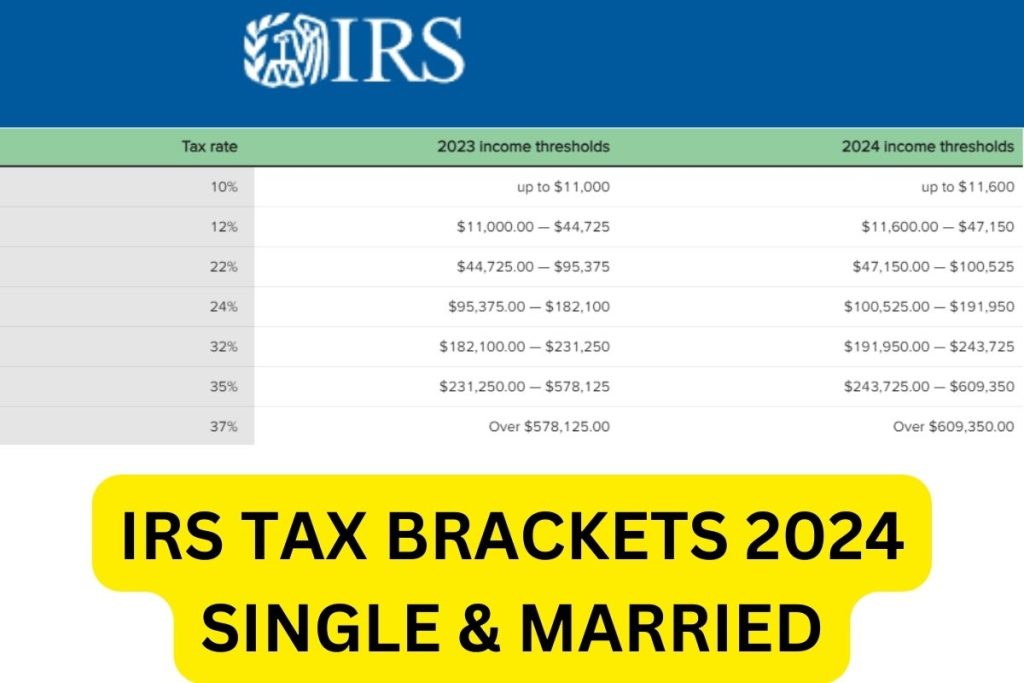

On November 9, 2023, the IRS released the updated tax brackets for the 2024 tax year, which will affect returns filed in 2025. The most significant change is the increase in income thresholds for each tax bracket, which is a response to inflation. The marginal tax rates remain unchanged from the previous year, with the following rates applicable:

- 10%

- 12%

- 22%

- 24%

- 32%

- 35%

- 37%

New Income Thresholds

The new income thresholds for the 2024 tax brackets are as follows:

- 10%: $0 to $11,600

- 12%: $11,600 to $47,150

- 22%: $47,150 to $100,525

- 24%: $100,525 to $182,100

- 32%: $182,100 to $231,250

- 35%: $231,250 to $578,125

- 37%: Over $578,125

These adjustments mean that taxpayers will need to earn more to reach higher tax brackets, effectively reducing their tax burden compared to previous years.

Standard Deductions for 2024

In addition to the tax brackets, the standard deduction has also been increased. For the 2024 tax year:

- Single filers and married individuals filing separately will see the standard deduction rise to $14,600, an increase of $750 from 2023.

- Heads of households will benefit from a standard deduction of $21,900, which is an increase of $1,100 from the previous year.

These increases in the standard deduction will help reduce taxable income for many taxpayers, providing additional relief amid rising costs.

Alternative Minimum Tax (AMT) Adjustments

The Alternative Minimum Tax (AMT) exemption amount for single filers will be $85,700 for the 2024 tax year, with the phase-out beginning at $609,350. This is an important consideration for higher-income earners who may be subject to AMT.

Where to Find More Information

For those looking for detailed information on the 2024 tax brackets and related adjustments, several reputable sources have published articles and resources:

- Forbes: IRS Announces 2024 Tax Brackets, Standard Deductions And Other Inflation Adjustments

- Tax Foundation: 2024 Tax Brackets and Federal Income Tax Rates

- IRS: IRS provides tax inflation adjustments for tax year 2024

- CNBC: IRS announces new income tax brackets for 2024

- CBS News: The IRS released its 2024 tax brackets. Here's how to see yours.

- NerdWallet: 2024 Federal Tax Brackets and Income Tax Rates

The 2024 tax brackets reflect the IRS's response to inflation, providing taxpayers with increased thresholds and standard deductions. As we move into the new tax year, it is crucial for individuals to understand these changes to effectively plan their finances and tax strategies. With the information provided, taxpayers can better navigate their tax obligations and take advantage of the adjustments made for the upcoming year.

For further updates and detailed analysis, taxpayers are encouraged to follow reliable financial news sources and consult with tax professionals.