Current News on VIX Stock: A Comprehensive Overview

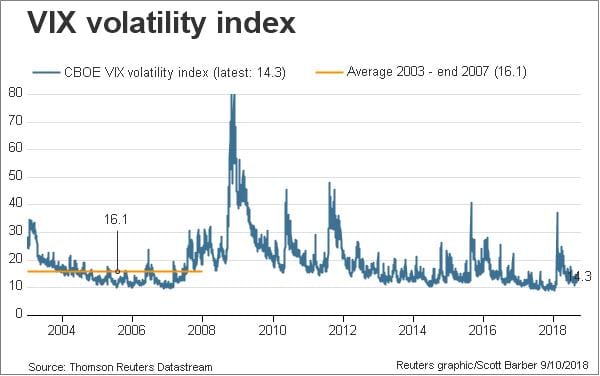

The CBOE Volatility Index (VIX), often referred to as the "fear gauge," is a key indicator of market volatility and investor sentiment. As of recent reports, the VIX has been experiencing significant fluctuations, reflecting the broader market's response to various economic factors. This article provides an extensive overview of the latest news and developments surrounding the VIX stock, including its recent performance, market implications, and expert insights.

Recent Performance of the VIX

The VIX has seen a notable increase in its value recently, with reports indicating a surge of over 34% in a single week. This spike is attributed to a combination of factors, including a sell-off in technology stocks and disappointing manufacturing data that unsettled the markets. The VIX's rise indicates heightened investor anxiety, as it typically increases when the stock market declines.

Key Statistics

- Current VIX Level: As of the latest updates, the VIX was reported at 20.17, a level that signifies increased market volatility.

- Historical Context: The VIX has fluctuated significantly, reaching as high as 65.73 in August before settling down. A reading above 20 is generally considered to indicate heightened volatility.

Factors Influencing the VIX

Several key factors have contributed to the recent movements in the VIX:

Tech Stock Declines: The decline in major tech stocks, particularly Nvidia, has had a ripple effect on the broader market, leading to increased volatility. The VIX jumped sharply as investors reacted to these declines.

Economic Data: Recent economic reports, including weaker-than-expected job growth, have influenced market sentiment. The U.S. economy added only 142,000 nonfarm payrolls in August, which was below expectations and raised concerns about economic stability.

Interest Rate Speculations: The market's reaction to economic data has also fueled speculation about potential interest rate cuts by the Federal Reserve. As Treasury yields plunged, the VIX spiked, reflecting investor uncertainty about future monetary policy.

Latest News Highlights

1. VIX Surges Amid Tech Stock Slide

- Source: MSN

- Summary: The VIX jumped significantly as Nvidia's stock continued to slide, reflecting broader market concerns. The semiconductor sector's struggles have unsettled investors, leading to increased volatility.

:max_bytes(150000):strip_icc()/dotdash_v3_Moving_Average_Strategies_for_Forex_Trading_Oct_2020-01-db0c08b0ae3a42bb80e9bf892ed94906.jpg)

2. Treasury Yields Plunge, VIX Spikes

- Source: Yahoo Finance

- Summary: Following disappointing job growth data, U.S. Treasury yields fell sharply, leading to a spike in the VIX. This development has heightened expectations for potential interest rate cuts.

3. Understanding the VIX Index

- Source: CNN

- Summary: An informative piece on the significance of the VIX index, detailing how it serves as a barometer for market volatility and can guide investment decisions.

4. Stock Market Today: Trade Setup

- Source: Live Mint on MSN.com

- Summary: Experts provide insights into the current stock market setup, including recommendations for stocks to buy or sell, amidst the backdrop of rising volatility indicated by the VIX.

5. Mystery Option Buyer Nets Fast Gains

- Source: Bloomberg

- Summary: A late-Friday options buyer capitalized on the market's volatility, netting approximately $12 million in gains as the S&P 500 Index plunged.

Implications for Investors

The recent movements in the VIX serve as a critical reminder for investors to remain vigilant. The increased volatility can present both risks and opportunities. Here are some considerations for investors:

- Risk Management: Investors should assess their portfolios and consider strategies to hedge against potential downturns, especially in volatile sectors like technology.

- Market Timing: The fluctuations in the VIX can provide insights into market timing for entry and exit points in various investments.

- Long-term Perspective: While short-term volatility can be unsettling, maintaining a long-term investment perspective is crucial for navigating market fluctuations.

:max_bytes(150000):strip_icc()/dotdash_v3_Moving_Average_Strategies_for_Forex_Trading_Oct_2020-01-db0c08b0ae3a42bb80e9bf892ed94906.jpg)

The CBOE Volatility Index (VIX) remains a vital tool for understanding market dynamics and investor sentiment. Recent spikes in the VIX highlight the ongoing uncertainty in the markets, driven by economic data, tech stock performance, and interest rate speculations. As investors navigate these turbulent waters, staying informed and adaptable will be key to making sound investment decisions.

For more detailed information and real-time updates, investors can refer to resources such as Yahoo Finance and MarketWatch.