Current News on the CBOE Volatility Index (VIX)

The CBOE Volatility Index (VIX), often referred to as the "Fear Gauge," is a key indicator of market volatility and investor sentiment. As of recent reports, the VIX has been experiencing significant fluctuations, reflecting broader market trends and investor reactions to economic data. Below is a comprehensive overview of the latest news and developments surrounding the VIX.

Overview of the VIX

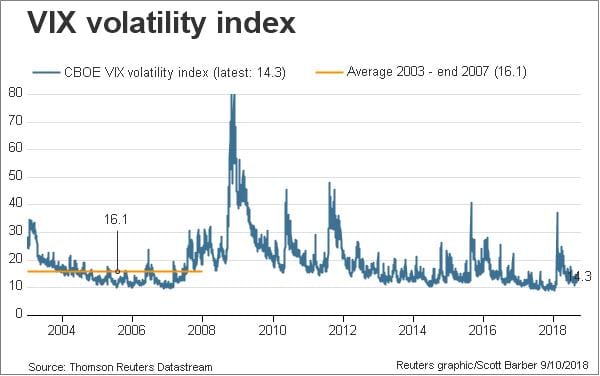

The VIX measures the market's expectation of future volatility based on options prices of the S&P 500 Index. A rising VIX indicates increased market uncertainty, while a declining VIX suggests a more stable market environment. The index is widely used by traders and investors to gauge market sentiment and to make informed trading decisions.

Recent Trends

Surge in Volatility: The VIX recently surged to its highest level of 2024, reflecting heightened market anxiety. On April 12, 2024, the VIX jumped 22.3% in a single day, reaching levels not seen since late October 2023. This spike was attributed to a broader market sell-off, particularly in the technology sector, which has been under pressure due to various economic factors.

Impact of Economic Data: The VIX's movements have been closely tied to economic indicators. For instance, a recent report indicated that U.S. Treasury yields plunged following disappointing job growth data, which in turn led to a spike in the VIX. The market reacted to the possibility of Federal Reserve interest rate cuts, further contributing to volatility.

Market Reactions: The VIX is often influenced by major corporate earnings reports and economic announcements. For example, the ongoing semiconductor selloff, particularly affecting companies like Nvidia, has contributed to the VIX's recent volatility. As Nvidia's stock continues to slide, the VIX has reacted accordingly, reflecting investor concerns about the tech sector's performance.

Key News Articles

1. VIX Surges as Nvidia Stock Continues To Slide

- Source: Investopedia on MSN.com

- Published: September 4, 2024

- Summary: The CBOE Volatility Index jumped amid a semiconductor selloff, indicating increased market anxiety. The article discusses how Nvidia's declining stock price has influenced the broader market and the VIX.

2. Treasury Yields Plunge, TLT ETF Tops $100, VIX Spikes

- Source: Benzinga on MSN.com

- Published: September 6, 2024

- Summary: This article highlights how weaker-than-expected job growth data has led to a rally in the U.S. Treasury market and a corresponding spike in the VIX, as investors adjust their expectations for future interest rate cuts.

3. What Investors Are Getting Wrong About the VIX Right Now

- Source: AOL

- Published: September 4, 2024

- Summary: This piece explores common misconceptions about the VIX, emphasizing that while it is a measure of volatility, its implications are more complex than simply being a "fear gauge."

Resources for Tracking the VIX

For those interested in tracking the VIX and its movements, several financial platforms provide real-time data, historical charts, and news updates:

- Yahoo Finance: CBOE Volatility Index (^VIX)

- Google Finance: VIX Index Overview

- MarketWatch: VIX Index Overview

- The Wall Street Journal: CBOE Volatility Index

The CBOE Volatility Index (VIX) remains a critical tool for investors and traders looking to navigate the complexities of the financial markets. Recent spikes in the VIX highlight the ongoing uncertainty and volatility in the market, driven by economic data and sector-specific challenges. As the market continues to react to various economic indicators, the VIX will likely remain a focal point for understanding investor sentiment and market dynamics.

For more detailed insights and updates, investors are encouraged to follow reputable financial news sources and utilize market tracking tools.

:max_bytes(150000):strip_icc()/dotdash_v3_Moving_Average_Strategies_for_Forex_Trading_Oct_2020-01-db0c08b0ae3a42bb80e9bf892ed94906.jpg)