Current Stock Market News Overview

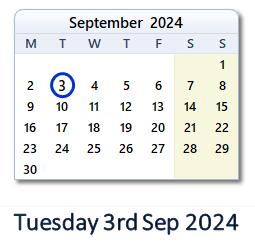

As of September 3, 2024, the stock market is experiencing significant fluctuations, with major indexes showing a downward trend. This report summarizes the latest developments in the stock market, highlighting key articles and insights from various financial news sources.

Major Market Movements

Dow Jones and Nasdaq Performance

Recent reports indicate that the Dow Jones Industrial Average has dropped over 550 points, marking a significant decline of approximately 1.5%. The Nasdaq Composite has also tumbled by 3.1%, reflecting a broader market downturn. This decline comes as investors react to various economic indicators and upcoming data releases that could impact market sentiment.

- MarketWatch reported on the current state of the stock market, emphasizing the decline in major indexes and the implications for investors. Read more here.

Economic Indicators and Job Data

The market's recent performance is influenced by the anticipation of key jobs data set to be released later this week. Analysts are closely monitoring these indicators as they could provide insights into the health of the economy and the potential for future interest rate adjustments by the Federal Reserve.

- An article from Business Insider discusses how September trading has begun with major indexes dipping as the market repositions itself ahead of these critical data points. Read the full article.

Investor Sentiment

Despite the recent downturn, there is a prevailing sense of bullishness among American investors. A report from the Wall Street Journal highlights that many individuals are optimistic about their investments, particularly as they review their 401(k) accounts. This sentiment is crucial as it reflects the confidence of retail investors in the market's long-term potential.

- For more insights on investor sentiment, check out this article: Americans Are Really, Really Bullish on Stocks.

Predictions and Market Outlook

Potential Market Declines

Some analysts are predicting a potential 10% drop in stock prices over the next eight weeks. This forecast is attributed to various factors, including seasonal trends and upcoming political events that may create uncertainty in the market.

- A detailed analysis can be found in this article: Why stocks could drop 10% over the next 8 weeks.

Historical Trends

Historically, the month of September has been challenging for the stock market, with the S&P 500 experiencing an average decline of 6% over the past four years. This trend raises concerns among traders as they navigate the current market landscape.

- For a deeper understanding of historical performance, refer to this article: How Stocks Typically Perform Late in the Year After Labor Day.

Sector-Specific News

Energy Sector Impact

The energy sector is also feeling the effects of recent market movements, particularly as oil prices have hit a 2024 low. This decline in oil prices is contributing to the overall bearish sentiment in the stock market, as traders recall the historical volatility associated with September trading.

- For more on this topic, see: Oil Prices Hit 2024 Low And Stocks Fall: Potentially Rocky September Kicks Off.

Investment Strategies

For those looking to invest in the current market climate, experts suggest considering index funds as a viable option, especially for those without extensive experience in stock trading. Index funds offer a diversified approach to investing, which can mitigate risks associated with individual stock volatility.

- Learn more about this investment strategy in the article: What's the Best Way to Invest in Stocks Without Any Experience? Try This Index Fund.

Conclusion

The stock market is currently navigating a complex landscape characterized by significant declines in major indexes, investor optimism, and critical economic indicators on the horizon. As we move further into September, market participants will be closely watching for data releases and trends that could influence future trading strategies.

For ongoing updates and detailed analyses, financial news platforms such as MarketWatch, CNBC, and Yahoo Finance remain essential resources for investors looking to stay informed about the latest developments in the stock market.

Stay tuned for more updates as the situation evolves.