Current Trends in U.S. Consumer Confidence: A Deep Dive

In recent weeks, U.S. consumer confidence has been a focal point of economic discussions, particularly as new data reveals significant fluctuations in consumer sentiment. The latest reports indicate a notable decline in consumer confidence, raising concerns about the overall economic outlook. This article will explore the recent trends, the factors influencing consumer confidence, and the implications for the economy.

Recent Declines in Consumer Confidence

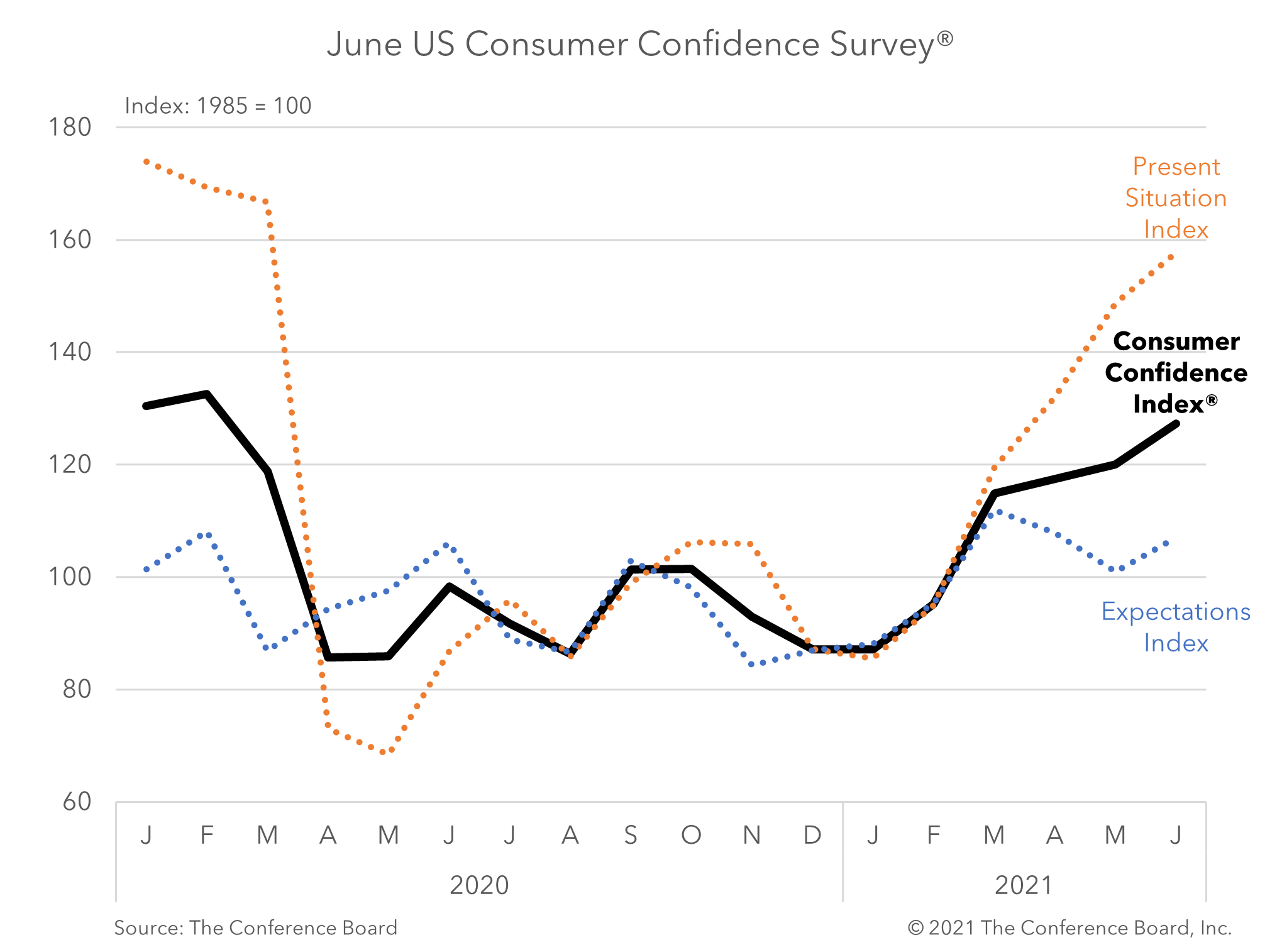

On September 24, 2024, the Conference Board reported that the Consumer Confidence Index dropped to 98.7, down from an upwardly revised 105.6 in August. This decline marks the largest decrease since August 2021, highlighting growing concerns among consumers regarding the labor market and broader economic conditions. The index's fall was unexpected, as analysts had anticipated a more stable reading around 103.9.

Key Factors Behind the Decline

Labor Market Fears: The primary driver of this decline appears to be anxiety over the labor market. Consumers are increasingly worried about job security and the potential for economic downturns, which can lead to reduced spending and investment.

Economic Outlook: The overall economic outlook has become more pessimistic, with consumers expressing concerns about inflation, interest rates, and potential recessionary pressures. This sentiment is particularly pronounced as the U.S. approaches a pivotal election, where economic performance is a critical issue.

Inflation and Interest Rates: Despite some easing in inflation rates, the lingering effects of high prices continue to weigh on consumer sentiment. High interest rates have also contributed to a cautious approach among consumers, who are wary of making significant purchases or investments.

Historical Context

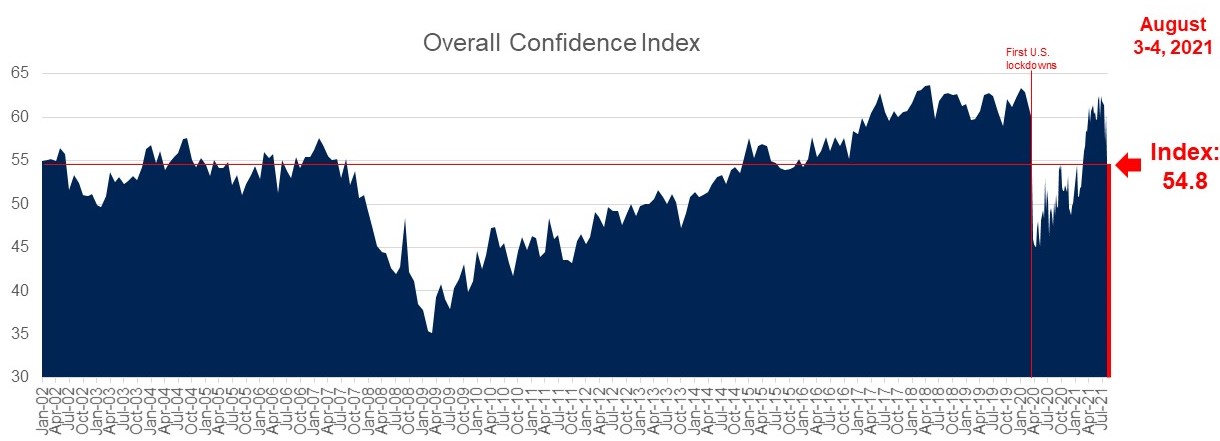

To understand the current situation, it is essential to look at the historical context of consumer confidence in the U.S. Over the past few years, consumer confidence has experienced significant fluctuations:

- In June 2023, consumer confidence surged to its highest level since early 2022, reaching 109.7. This increase was attributed to a strong labor market and positive economic indicators.

- However, by October 2023, the index had fallen to 102.6, marking a third consecutive month of decline. This downward trend reflects growing concerns about the economy's resilience in the face of rising costs and interest rates.

Implications for the Economy

The decline in consumer confidence has several implications for the U.S. economy:

Reduced Consumer Spending: As consumer confidence wanes, spending is likely to decrease. This reduction can lead to slower economic growth, as consumer spending is a significant driver of the U.S. economy.

Impact on Businesses: Businesses may face challenges as consumers become more cautious. This shift can lead to decreased sales, impacting profitability and potentially leading to layoffs or reduced hiring.

Policy Responses: Policymakers may need to respond to these trends by considering measures to bolster consumer confidence. This could include adjustments to monetary policy, such as interest rate cuts, or fiscal measures aimed at stimulating economic activity.

Looking Ahead

As we move forward, the trajectory of consumer confidence will be closely monitored. Key factors to watch include:

- Labor Market Developments: Any signs of improvement or deterioration in the labor market will significantly influence consumer sentiment.

- Inflation Trends: Continued monitoring of inflation rates and their impact on purchasing power will be crucial.

- Political Climate: The upcoming election and its implications for economic policy will also play a vital role in shaping consumer confidence.

In conclusion, the recent decline in U.S. consumer confidence underscores the complexities of the current economic landscape. As consumers grapple with uncertainties regarding the labor market and inflation, the implications for spending and economic growth are significant. Stakeholders across the economy will need to remain vigilant and responsive to these changing dynamics to navigate the challenges ahead.

For further details, you can explore the full articles from sources like Reuters, MarketWatch, and Bloomberg that provide in-depth analysis and updates on consumer confidence trends.