Current News on Interest Rates: Key Updates and Insights

As of September 18, 2024, the financial world is abuzz with discussions surrounding the Federal Reserve's anticipated decision on interest rates. With a staggering 10.8 million search results for "current news for interest rates today," it's clear that this topic is at the forefront of economic discussions. Here’s a comprehensive overview of the latest developments, market expectations, and implications for consumers and investors.

Federal Reserve Meeting: A Pivotal Moment

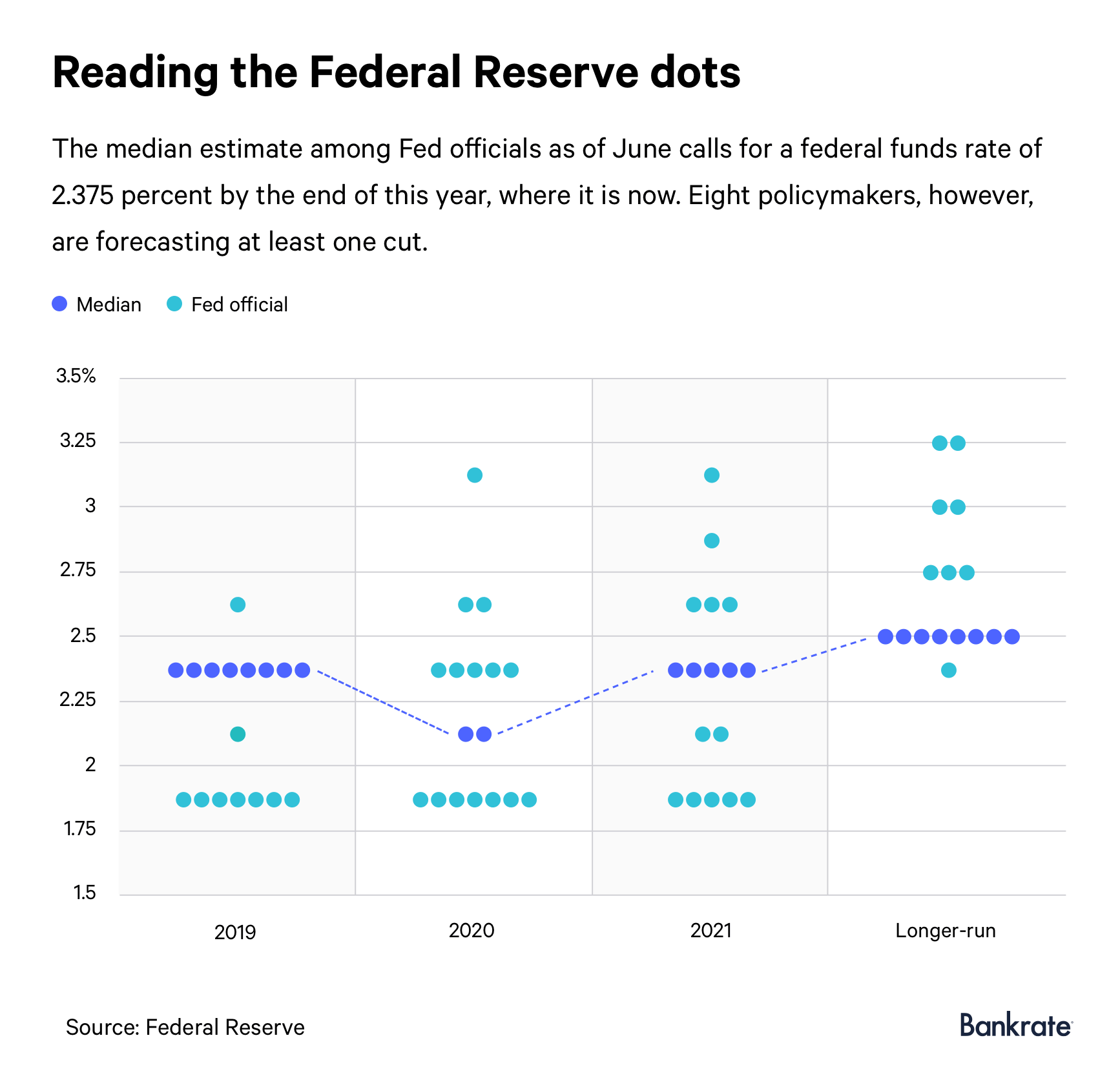

The Federal Reserve is currently holding a crucial meeting that could lead to significant changes in interest rates. As of this morning, market analysts are pricing in a 63% chance of a half-point rate cut and a 37% chance of a quarter-point reduction. This potential shift comes as the Fed grapples with the ongoing challenges of inflation and economic stability.

Key Articles and Insights

MarketWatch reports that Wall Street is on edge as the Fed meeting unfolds. Investors are closely monitoring the situation, with many speculating on how the Fed's decisions will impact the broader economy. Read more here.

Bankrate provides an update on current mortgage rates, noting that the average interest rate for a 30-year fixed mortgage is currently at 6.29%, which has decreased by 8 basis points over the past week. This decline is significant for potential homebuyers and those looking to refinance. Check the latest rates.

Forbes Advisor highlights the average annual percentage rates for various mortgage types, indicating that the 30-year fixed mortgage remains a popular choice among consumers. Explore the details.

NerdWallet also reports on the mixed trends in mortgage rates, with the average rate on a 30-year fixed-rate mortgage dropping to 6.11% as of September 6, 2024. Find out more.

Anticipated Rate Cuts: What to Expect

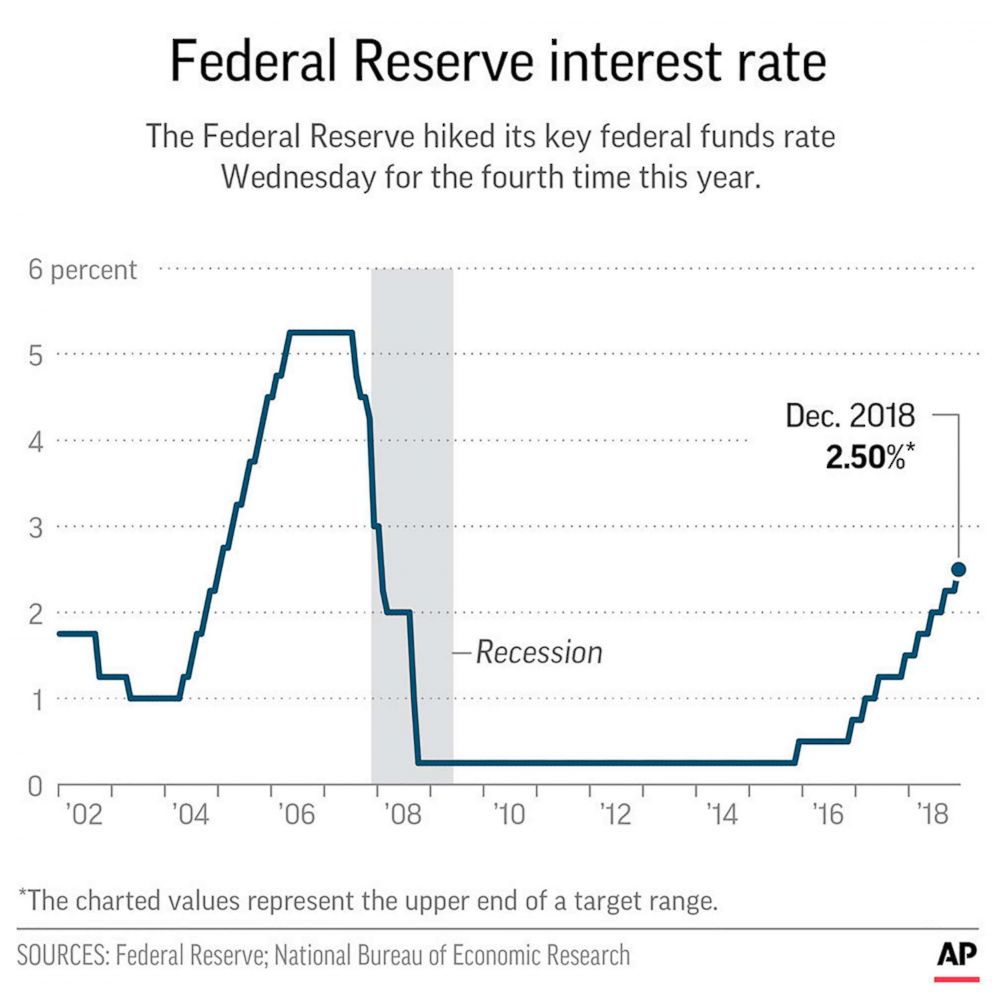

The Fed's potential decision to cut interest rates for the first time since 2020 is generating considerable interest. Analysts suggest that if the Fed proceeds with a rate cut, it could lead to lower borrowing costs for consumers, impacting everything from credit cards to auto loans.

Recent News Highlights

USA Today reports on the Fed's expected rate cut, emphasizing that if implemented, borrowers will likely see a decrease in interest rates across various financial products. Read the full article.

ABC News discusses the implications of the Fed's decision, noting that investors are keenly awaiting the outcome of this pivotal meeting. Learn more here.

The Associated Press highlights the uncertainty surrounding the size of the potential rate cut, indicating that while a reduction is expected, the exact magnitude remains unclear. Read more.

CNBC reports a surge in mortgage demand, with a 14% increase as interest rates hit a two-year low. This trend suggests that consumers are eager to take advantage of favorable borrowing conditions. Check the details.

Implications for Consumers and Investors

The potential for a rate cut by the Federal Reserve could have far-reaching implications for both consumers and investors. Here are some key takeaways:

Lower Borrowing Costs: A reduction in interest rates would likely lead to lower costs for loans, making it more affordable for consumers to finance purchases such as homes and cars.

Increased Consumer Spending: With lower interest rates, consumers may feel more confident in their financial situations, potentially leading to increased spending and stimulating economic growth.

Market Reactions: Investors are closely watching the Fed's decisions, as changes in interest rates can significantly impact stock prices and market dynamics.

Mortgage Market Dynamics: As mortgage rates are influenced by the Fed's policies, a rate cut could lead to a decrease in mortgage rates, encouraging more homebuyers to enter the market.

As the Federal Reserve deliberates on its next steps regarding interest rates, the financial landscape remains dynamic and uncertain. With a potential rate cut on the horizon, both consumers and investors are poised to react to the outcomes of this pivotal meeting. The implications of these decisions will resonate throughout the economy, influencing everything from consumer spending to investment strategies.

For ongoing updates and detailed analysis, keep an eye on reputable financial news sources and market reports. The next few days will be crucial in shaping the economic outlook for the remainder of the year.