Current News on Federal Reserve Rate Cuts

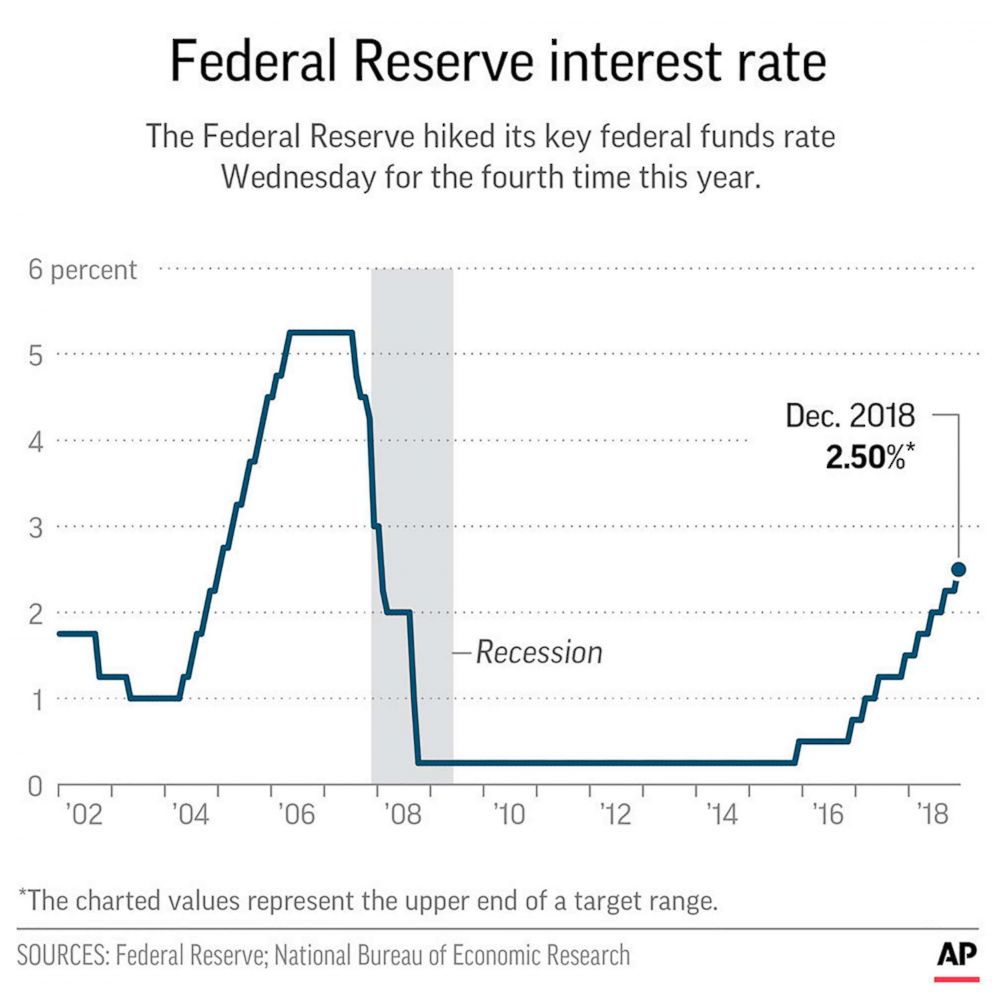

As the Federal Reserve prepares for a pivotal meeting, the financial world is abuzz with speculation about potential interest rate cuts. This marks a significant moment, as it could be the first rate cut in four years. The anticipation surrounding this decision is palpable, with various news outlets providing live updates and expert analyses.

Key Developments

Upcoming Fed Meeting: The Federal Reserve is set to meet on September 18, 2024, to discuss the possibility of cutting interest rates. This meeting is crucial as it could signal a shift in monetary policy after a prolonged period of high rates aimed at combating inflation.

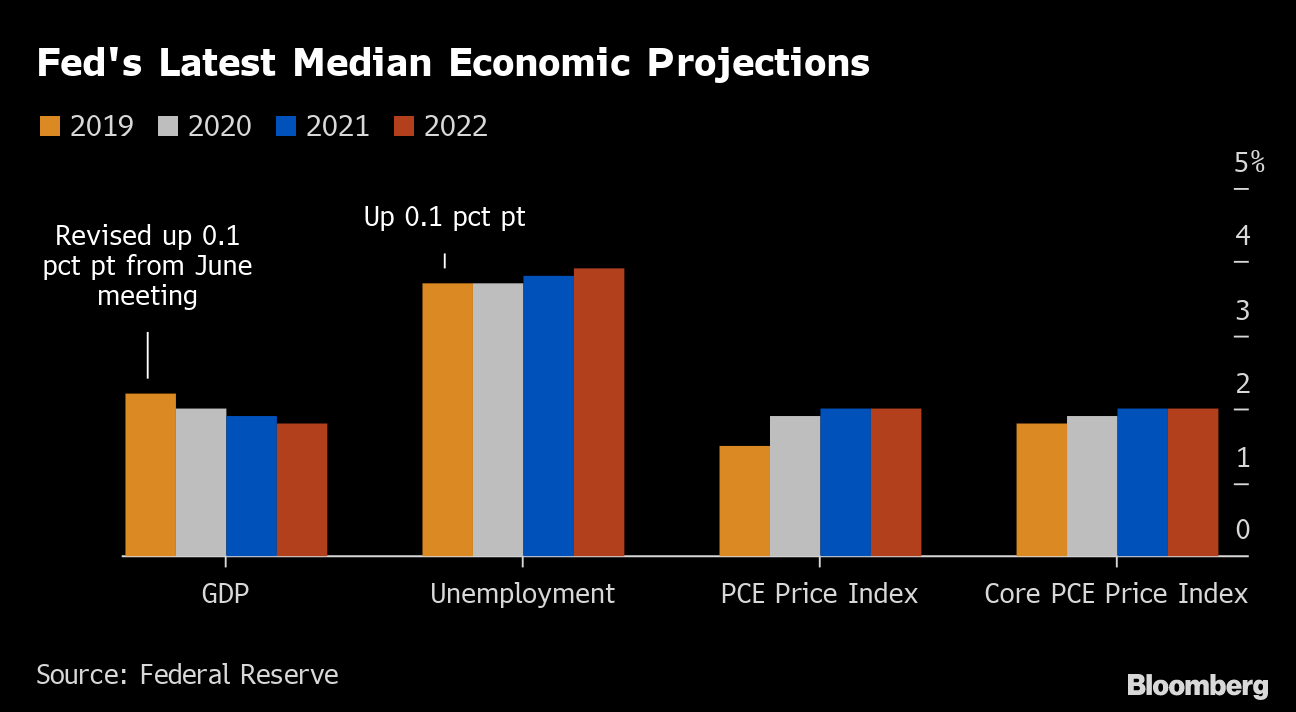

Inflation Trends: Recent reports indicate that inflation has significantly decreased, dropping from a peak of 9.1% in June 2022 to around 2.5% last month. This decline has led many economists to believe that the Fed may feel more comfortable easing rates, which could provide relief to consumers and stimulate economic growth.

Market Reactions: The stock market has shown mixed reactions as investors brace for the Fed's decision. Many are speculating whether the cut will be 25 basis points or 50 basis points, with implications for various sectors, including mortgages and auto loans.

Expert Opinions: Financial analysts and economists are weighing in on the potential impacts of a rate cut. Some suggest that a larger cut could indicate underlying economic concerns, while others argue it could be a necessary step to support growth in a slowing job market.

Recent Articles and Insights

1. USA Today: Fed Meeting Live Updates

- Published: September 18, 2024

- Summary: The article discusses the potential for the Fed to ease the highest interest rates seen in a generation. It highlights how a rate cut could affect borrowers, particularly in terms of credit card and auto loan rates. Read more here.

2. NBC News: A Fed Rate Cut is Coming

- Published: September 17, 2024

- Summary: This piece explores the implications of a potential rate cut, noting that mortgage rates have reached their lowest since February 2023. The article emphasizes the uncertainty surrounding the size of the cut. Read more here.

3. CNN: The Fed is Finally About to Cut Interest Rates

- Published: September 16, 2024

- Summary: CNN outlines the significance of the upcoming Fed meeting, marking it as a pivotal week for the U.S. economy. The article discusses the historical context of the Fed's rate decisions and the potential for a major shift in policy. Read more here.

4. AP News: The Fed is Set to Cut Interest Rates

- Published: September 18, 2024

- Summary: This article provides insights from Fed Chair Jerome Powell, who has indicated confidence in the Fed's ability to manage inflation. It discusses the implications of a rate cut for the broader economy. Read more here.

5. New York Times: A Fed Rate Cut Would Cap a Winning Streak for Biden and Harris

- Published: September 18, 2024

- Summary: The article discusses the political ramifications of a rate cut, suggesting that it could bolster the current administration's standing. It also raises concerns about the potential negative perceptions of a larger cut. Read more here.

What to Expect from the Rate Cut

The anticipated rate cut is expected to have several implications for consumers and the economy:

Lower Borrowing Costs: A reduction in the federal funds rate could lead to lower interest rates on loans, making it cheaper for consumers to borrow money for homes, cars, and other purchases.

Stimulus for Economic Growth: By easing borrowing costs, the Fed aims to stimulate spending and investment, which could help bolster economic growth in a slowing job market.

Market Volatility: While a rate cut may provide immediate relief, it could also lead to increased volatility in the stock market as investors react to the Fed's decision and its implications for future economic conditions.

As the Federal Reserve approaches its meeting, the financial community is closely monitoring developments regarding potential interest rate cuts. With inflation showing signs of easing and economic conditions shifting, the Fed's decision could have far-reaching effects on consumers, businesses, and the overall economy. The anticipation surrounding this meeting underscores the importance of the Fed's role in navigating the complexities of the current economic landscape.

For ongoing updates, you can follow the live coverage from various news outlets, including USA Today, NBC News, and CNN.