Current News on Federal Reserve Rate Cuts

As the Federal Reserve prepares for its upcoming meetings, the financial world is abuzz with speculation regarding potential interest rate cuts. Recent reports indicate that the Fed is expected to lower rates by 25 basis points at its next meeting on September 18, 2024, with further cuts anticipated throughout the year. This article will delve into the latest developments, expert opinions, and the implications of these potential rate cuts on the economy and markets.

Overview of Expected Rate Cuts

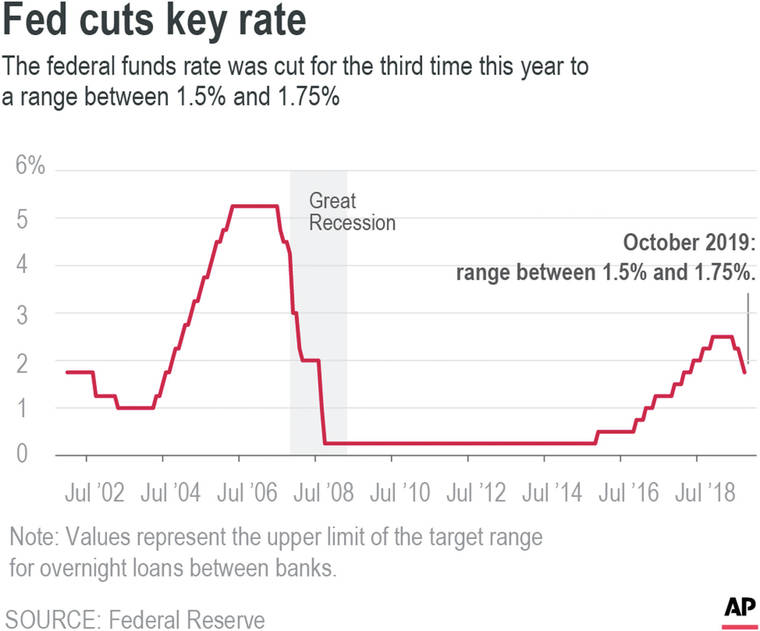

According to a Reuters poll, a majority of economists predict that the Federal Reserve will implement a series of rate cuts during its remaining policy meetings in 2024. The anticipated cuts are seen as a response to the current economic climate, which has been characterized by high inflation and rising borrowing costs. The Fed's decision to lower rates is expected to stimulate economic growth and provide relief to consumers and businesses alike.

Key Articles and Insights

Fed to Cut Rates by 25 Basis Points on Sept. 18

Published on September 10, 2024, this article highlights the consensus among economists regarding the Fed's upcoming rate cuts. The report emphasizes that the Fed's decision will be influenced by the health of the U.S. economy, which has shown signs of resilience despite inflationary pressures. Read more here.Will the Fed Cut Interest Rates Fast Enough to Deliver a ‘Soft Landing’?

This article from AP News, published on September 16, 2024, discusses the implications of the Fed's potential rate cuts on the housing market. It notes that the average 30-year mortgage rate has already dropped to 6.2%, the lowest level in 18 months, as markets anticipate the Fed's actions. Read more here.As Federal Reserve Readies Interest Rate Cut, Risks to Job Market Still Loom

This New York Times article, published on September 16, 2024, outlines the potential risks associated with the Fed's decision to cut rates. While the cuts may provide short-term relief, there are concerns about their long-term impact on the job market and overall economic stability. Read more here.Fed Rate Cuts Will Not Be as Deep as the Market Expects, Says BlackRock

In a note released on September 16, 2024, BlackRock cautioned that the Fed's rate cuts may not be as substantial as the market anticipates. The firm attributes this to a resilient economy and persistent inflation, suggesting that the Fed may adopt a more cautious approach. Read more here.

Market Reactions and Predictions

The anticipation of rate cuts has led to significant movements in the financial markets. Investors are closely monitoring the Fed's actions, as they could have profound implications for various sectors, including real estate, consumer spending, and stock markets.

Impact on the Stock Market

Historically, rate cuts have been associated with positive movements in the stock market. Analysts suggest that the S&P 500 may respond favorably to the Fed's decision, as lower borrowing costs typically encourage investment and consumer spending. However, some experts warn of potential volatility in the markets following the announcement, as investors adjust their expectations based on the Fed's guidance.

Consumer Implications

For consumers, the expected rate cuts could lead to lower interest rates on loans, including mortgages, car loans, and credit cards. This could provide much-needed relief for households struggling with high debt levels. However, the long-term effects of these cuts on inflation and economic growth remain uncertain.

As the Federal Reserve gears up for its next meeting, the financial world is watching closely. The anticipated rate cuts are expected to have significant implications for the economy, markets, and consumers. While many economists are optimistic about the potential benefits of these cuts, there are also concerns about the long-term effects on inflation and employment.

For those interested in staying updated on this evolving situation, numerous articles and analyses are available, providing insights into the Fed's decisions and their potential impact on the economy. As we approach the September 18 meeting, the anticipation continues to build, and the outcomes will undoubtedly shape the economic landscape for the remainder of the year.

For more detailed information, you can explore the following resources:

- Reuters on Fed Rate Cuts

- AP News on Interest Rates

- New York Times on Job Market Risks

- BlackRock's Insights

Stay tuned for further updates as the situation develops!