Navient Settlement: Key Developments and Implications for Borrowers

In a significant legal development, Navient, one of the largest student loan servicers in the United States, has reached a $120 million settlement with the Consumer Financial Protection Bureau (CFPB). This settlement comes as a result of allegations regarding the company's misleading practices in servicing student loans, which have affected countless borrowers across the nation.

Background of the Settlement

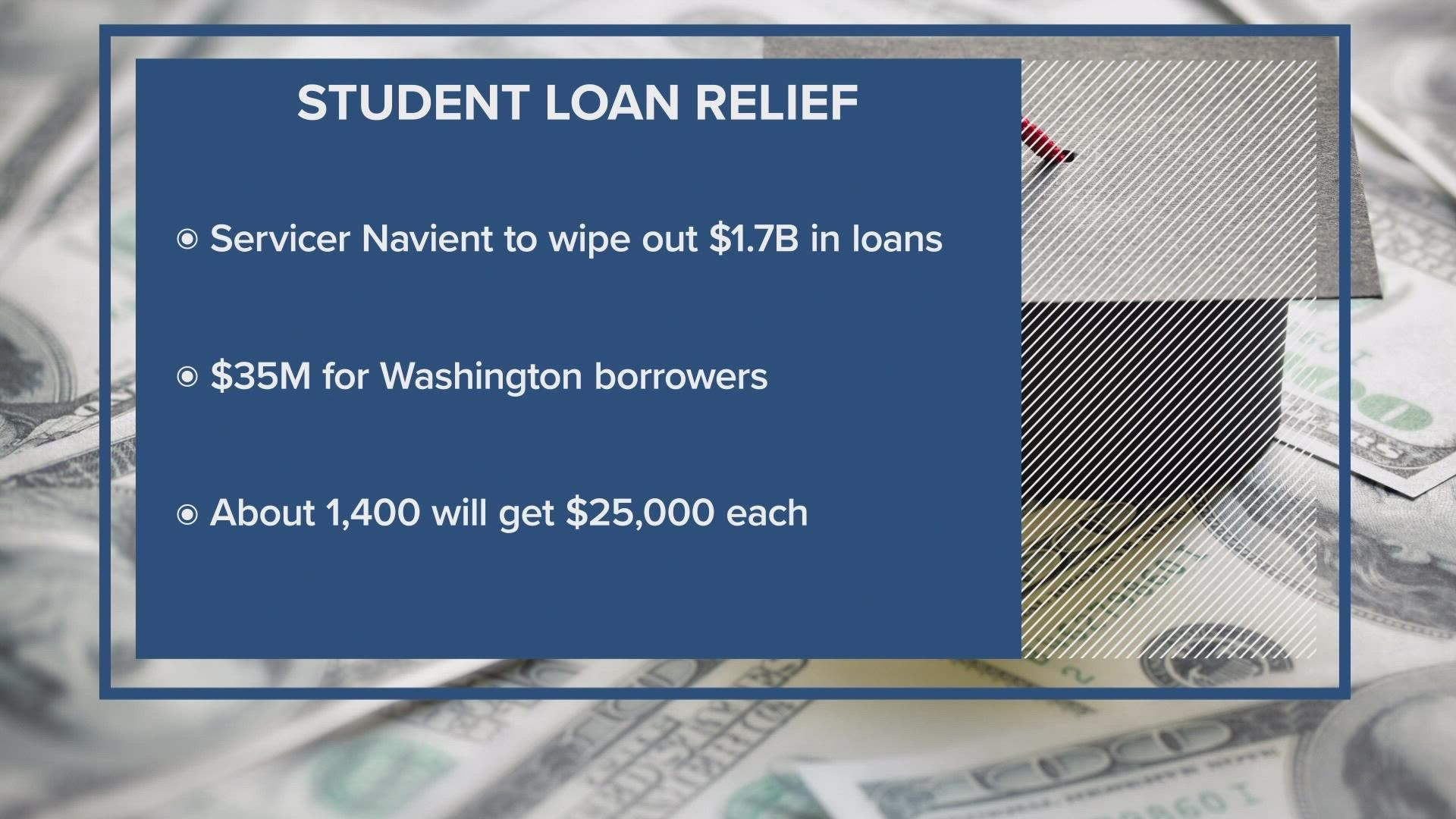

The recent settlement is part of a broader trend of legal actions against Navient, which has faced scrutiny for its handling of student loans. In 2022, Navient was involved in a $1.85 billion settlement with 39 state attorneys general, addressing claims of predatory lending practices and improper loan servicing. This earlier settlement required Navient to cancel approximately $1.7 billion in student loan debts owed by over 66,000 borrowers.

The current settlement, announced on September 12, 2024, not only imposes a financial penalty but also bans Navient from servicing federal student loans in the future. This marks a significant shift in the landscape of student loan servicing, as the company has been a major player in this sector for years.

Details of the Settlement

Financial Compensation

Under the terms of the new settlement, Navient is required to pay $120 million in total, which includes:

- $100 million in compensation to borrowers who were harmed by the company's practices.

- A $20 million penalty to the CFPB.

This financial compensation is expected to benefit a large number of borrowers, with estimates suggesting that hundreds of thousands could receive payments.

Cancellation of Debts

In addition to the financial penalties, the settlement mandates that Navient must cancel delinquent private student loan debts for more than 66,000 borrowers. This is a crucial aspect of the settlement, as it directly addresses the financial burdens faced by many individuals who have struggled to repay their loans.

Implications for Borrowers

The implications of this settlement are profound for borrowers who have been affected by Navient's practices. Many individuals have reported difficulties in managing their student loans, often due to misleading information provided by servicers. The settlement aims to rectify some of these issues by providing financial relief and ensuring that borrowers are treated fairly in the future.

Future of Student Loan Servicing

With Navient being banned from servicing federal student loans, the landscape of student loan servicing is likely to change. This decision may lead to increased scrutiny of other servicers and could prompt regulatory changes aimed at protecting borrowers from predatory practices.

Reactions to the Settlement

The settlement has been met with a mix of relief and skepticism. Advocates for borrowers have welcomed the financial compensation and debt cancellation, viewing it as a step towards accountability for student loan servicers. However, there are concerns about the effectiveness of such settlements in preventing future misconduct.

Consumer Advocacy Groups

Consumer advocacy groups have expressed hope that this settlement will serve as a precedent for future actions against other servicers. They argue that more needs to be done to protect borrowers from misleading practices and to ensure that they have access to accurate information regarding their loans.

The Navient settlement represents a significant moment in the ongoing battle for student loan reform. With $120 million in compensation and a ban on servicing federal loans, the settlement aims to provide relief to borrowers who have been adversely affected by the company's practices. As the landscape of student loan servicing evolves, it remains to be seen how this will impact borrowers and the broader financial aid system in the United States.

For those interested in further details, the full articles can be found on major news outlets such as CBS News, The New York Times, and NPR. The ongoing developments in this case will likely continue to shape discussions around student loan policies and borrower protections in the future.