Current News on Interest Rates: A Comprehensive Overview

As of September 2024, the landscape of interest rates in the United States is undergoing significant changes, primarily driven by the actions and statements of the Federal Reserve. This report summarizes the latest developments, implications for the economy, and what consumers can expect moving forward.

Federal Reserve's Stance on Interest Rates

Recent Announcements

On August 23, 2024, Jerome Powell, the Chair of the Federal Reserve, indicated that the Fed is poised to begin reducing interest rates from their current 23-year high. This announcement comes as inflation appears to be under control and the job market shows signs of cooling. However, Powell did not specify when these cuts would commence or the magnitude of the reductions. This statement has sparked discussions among economists and market analysts about the potential timing and impact of such cuts on the economy.

For more details, you can read the full article on AP News.

Historical Context

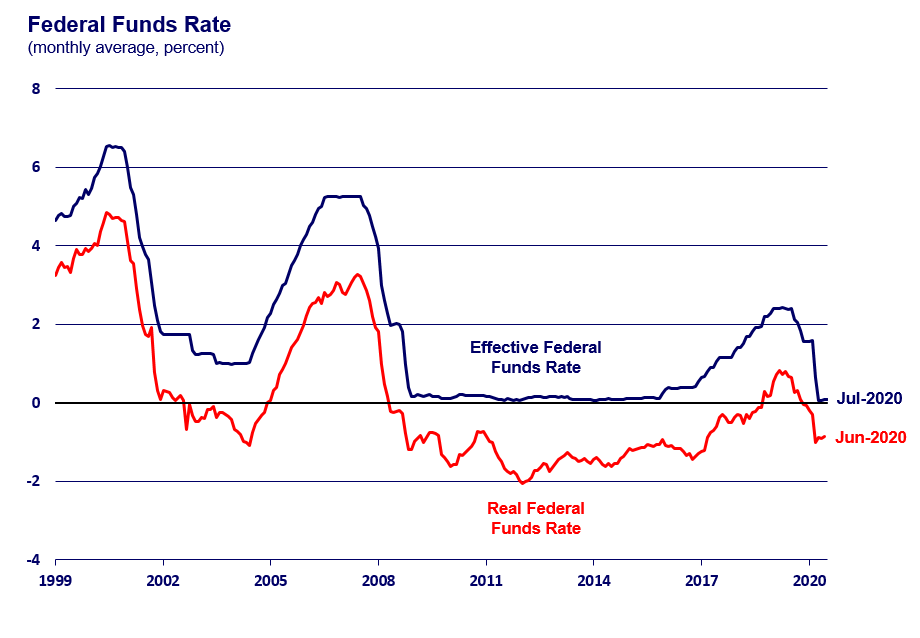

The Federal Reserve has maintained interest rates at a 23-year high for nearly a year, following an aggressive rate-hiking campaign that began in March 2022. The Fed's decision to keep rates high was largely influenced by persistent inflation, which has been a significant concern for policymakers. The latest data suggests that inflation is stabilizing, prompting the Fed to consider a shift in its monetary policy.

Key Takeaways from Recent Fed Meetings

- Interest Rate Stability: The Fed has kept rates unchanged at 5.25% to 5.5% as of May 1, 2024, indicating a cautious approach to any potential cuts.

- Future Projections: The Fed's projections suggest a belief that inflation can be managed without causing significant job losses, which is a delicate balance to maintain.

- Market Reactions: Financial markets are closely monitoring the Fed's signals, as any changes in interest rates can have profound effects on various sectors, including housing and consumer spending.

For a deeper dive into the Fed's latest decisions, check out the analysis on CNN.

Implications for Consumers and the Housing Market

Expected Changes in Mortgage Rates

With the Federal Reserve expected to cut interest rates soon, the housing market is bracing for a shift. Analysts predict that mortgage rates, which have hovered around 7%, may begin to decline. This could lead to increased activity in the housing market, as lower rates typically encourage home buying and refinancing.

- Current Mortgage Rates: As of September 11, 2024, the median interest rate on a 30-year fixed-rate mortgage is reported at 5.990%, a slight decrease from previous days. This trend is expected to continue as the Fed implements rate cuts.

- Impact on Home Sales: A reduction in mortgage rates could stimulate home sales, which have been sluggish due to high borrowing costs. The housing market is keenly watching the Fed's next moves, as lower rates could revitalize demand.

For the latest mortgage rate updates, visit Wall Street Journal.

Broader Economic Effects

The anticipated cuts in interest rates are not just limited to the housing market. They could have far-reaching implications for various sectors of the economy:

- Consumer Spending: Lower interest rates generally lead to increased consumer spending, as borrowing becomes cheaper. This could boost economic growth in the short term.

- Investment: Businesses may also benefit from lower borrowing costs, potentially leading to increased investment in expansion and hiring.

- Stock Market: The stock market often reacts positively to rate cuts, as lower interest rates can lead to higher corporate profits and increased consumer spending.

The current trajectory of interest rates in the United States is poised for a significant shift, with the Federal Reserve indicating a readiness to cut rates in response to improving economic conditions. As consumers and businesses prepare for these changes, the implications for the housing market, consumer spending, and overall economic growth will be closely monitored.

For ongoing updates and detailed analysis, keep an eye on reputable news sources such as NBC News and New York Times.

In summary, the landscape of interest rates is evolving, and understanding these changes is crucial for consumers, investors, and policymakers alike.