Current News on Inflation Report: Key Highlights

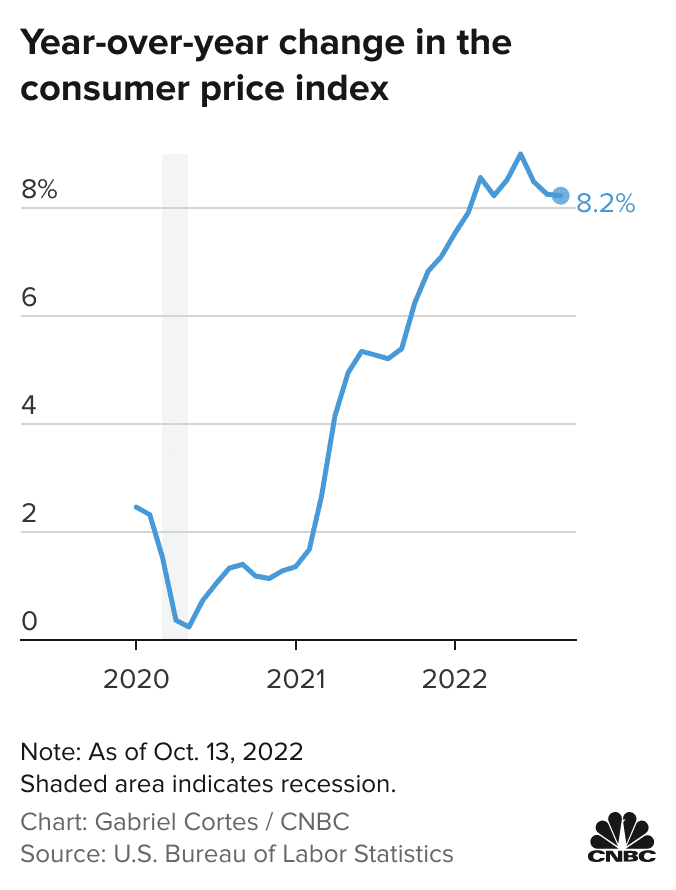

As of September 11, 2024, the latest Consumer Price Index (CPI) report has revealed significant developments in the U.S. inflation landscape. This report is crucial as it influences the Federal Reserve's monetary policy decisions, particularly regarding interest rates. Here’s a comprehensive overview of the current situation based on recent news articles and reports.

Overview of the CPI Report

The CPI report published by the Labor Department indicates that consumer prices rose by 2.5% in August compared to the previous year. This marks the fifth consecutive month of declining inflation rates, reaching the lowest level since February 2021. The report has been welcomed by many as it suggests that inflation is easing, which could pave the way for potential interest rate cuts by the Federal Reserve.

Key Findings from the Report

Gasoline Prices: The cost of gasoline and diesel has been decreasing, with the average price of regular gasoline falling to $3.39 per gallon in August, a drop of nearly 12% from the previous month. This decline is seen as a positive sign in the fight against inflation.

Core Inflation: Excluding volatile items such as food and energy, the core CPI rose by 0.3% from July, indicating that underlying inflation pressures remain steady. The year-over-year core inflation rate stands at 3.2%.

Market Reactions: Following the release of the CPI report, the stock market experienced volatility. The Dow Jones Industrial Average fell by nearly 700 points, reflecting investor concerns that the inflation data may reduce the likelihood of a significant interest rate cut by the Federal Reserve.

:max_bytes(150000):strip_icc()/consumerpriceindex_final-2bbbfc247d8e48c5b73b8b9a3d151a16.png)

Federal Reserve's Response

The Federal Reserve is closely monitoring inflation trends as it prepares for its upcoming meeting. The current CPI data suggests that while inflation is cooling, it may not be enough to warrant a jumbo-sized rate cut. Analysts predict that the Fed is likely to implement a quarter-point rate cut rather than a more aggressive reduction.

Implications for Interest Rates

Interest Rate Cuts: The latest inflation figures have led to speculation that the Federal Reserve may cut interest rates in its next meeting. However, the modest nature of the CPI report has left some investors dissatisfied, as they were hoping for a more substantial reduction.

Market Sentiment: Wall Street's reaction has been mixed, with some analysts expressing concerns that the current inflation data does not provide enough justification for a significant shift in monetary policy.

Additional Insights from Recent Articles

Several reputable news sources have provided further insights into the implications of the CPI report:

New York Times: Reports that the inflation data is a welcome relief for consumers, as it indicates a potential easing of financial pressures. The article emphasizes the importance of monitoring energy prices, which have a significant impact on overall inflation.

PBS NewsHour: Highlights that the latest inflation figures could influence the Federal Reserve's decision-making process, particularly as the economy continues to recover from the pandemic.

AP News: Discusses how the easing inflation rates may provide the Fed with more flexibility in its monetary policy, potentially leading to a more accommodative stance in the coming months.

The latest CPI report has painted a cautiously optimistic picture of the U.S. inflation landscape. With inflation rates hitting a three-year low, there is hope for consumers and businesses alike. However, the Federal Reserve's upcoming decisions will be critical in determining the trajectory of interest rates and overall economic stability.

For those interested in following the developments closely, here are some useful links to the latest articles and reports:

- CPI Report Live Updates - New York Times

- U.S. Inflation Hits a 3-Year Low - PBS NewsHour

- AP News on Inflation Easing - AP News

As the situation evolves, it will be essential to keep an eye on both inflation trends and the Federal Reserve's responses to ensure informed financial decisions moving forward.