Current News on CPI Report: Key Insights and Implications

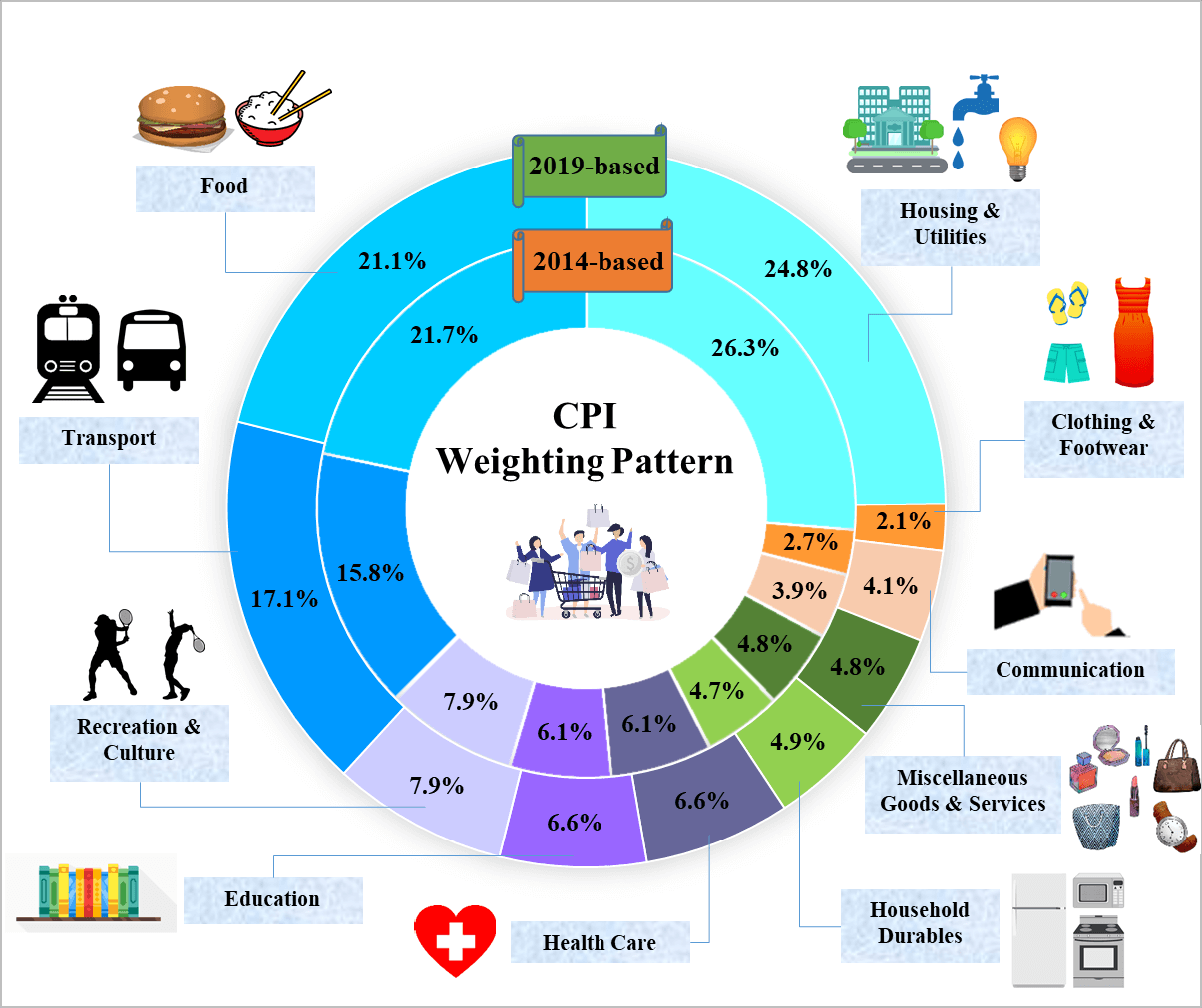

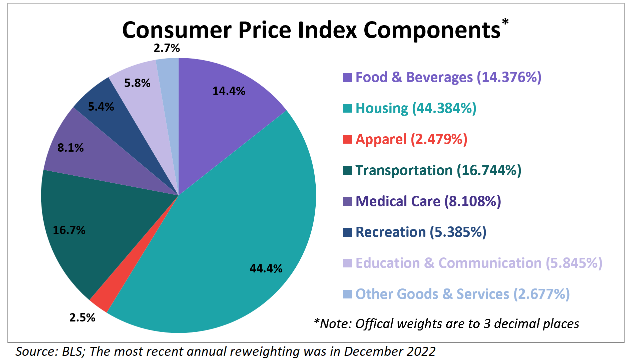

The Consumer Price Index (CPI) report is a critical economic indicator that reflects the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. As of September 11, 2024, the latest updates surrounding the CPI report indicate a significant focus on inflation trends and their implications for monetary policy, particularly regarding the Federal Reserve's interest rate decisions.

Recent Developments

CPI Report Live Updates

According to a recent article from the New York Times, the CPI report is expected to show that inflation remains subdued. The report highlights a decline in the cost of gasoline and diesel, which is seen as a positive development in the fight against inflation. In August, the average price of regular gasoline was reported at $3.39 per gallon, marking a nearly 12% decrease from previous months. This decline is crucial as it contributes to the overall inflation narrative, potentially easing pressure on consumers and policymakers alike. Read more here.

Market Reactions and Expectations

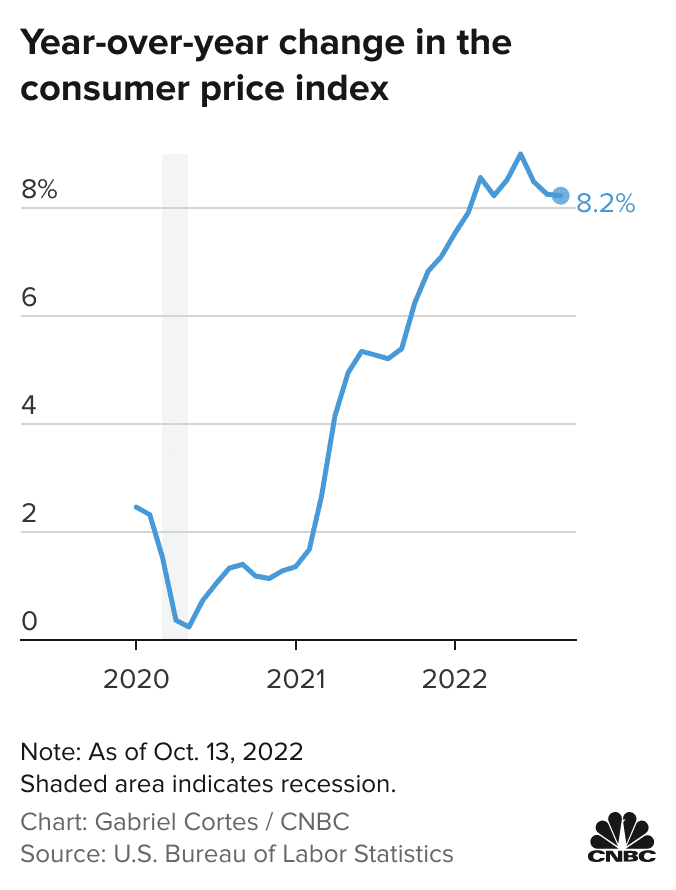

The MarketWatch report indicates that the CPI data, which was released on the same day, is anticipated to show a modest increase of 0.2% in overall consumer prices for August. Economists surveyed by the Wall Street Journal predict that this increase will weigh heavily on the Federal Reserve's plans for interest rate cuts. The report emphasizes that the upcoming CPI data could significantly influence the Fed's decision-making process regarding monetary policy. Read more here.

Federal Reserve's Rate-Cut Considerations

As the Federal Reserve prepares for its next meeting, the CPI report is one of the last major data releases that could impact their decision on interest rates. A report from the Wall Street Journal suggests that a surprisingly weak CPI reading could bolster the case for the Fed to accelerate its rate-cutting strategy. The anticipation surrounding the CPI data is palpable, with many investors closely monitoring the situation. Read more here.

Broader Economic Context

The CPI report is not just a number; it reflects broader economic conditions. The U.S. Bureau of Labor Statistics reported that in July, the CPI for All Urban Consumers rose 0.2%, seasonally adjusted, and increased 2.9% over the last year. This data is critical as it provides insights into the inflationary pressures affecting consumers and the economy at large. Read more here.

Implications for Investors

The stock market is reacting to the CPI data, with Dow futures dipping as traders await the inflation report. Concerns over falling oil prices and economic conditions in China are contributing to market volatility. The Dow Jones Industrial Average futures were reported down 0.4%, indicating a cautious approach among investors. Read more here.

Key Takeaways

- Inflation Trends: The CPI report indicates a modest increase in inflation, with gasoline prices falling, which may ease consumer pressure.

- Federal Reserve's Strategy: The upcoming CPI data is crucial for the Federal Reserve's interest rate decisions, with potential implications for rate cuts.

- Market Reactions: Investors are closely monitoring the CPI report, with market fluctuations reflecting concerns over inflation and economic conditions.

- Broader Economic Indicators: The CPI serves as a vital indicator of economic health, influencing consumer behavior and policy decisions.

The current news surrounding the CPI report underscores its importance in shaping economic policy and market dynamics. As inflation trends evolve, the implications for the Federal Reserve's interest rate strategy and overall economic health will be closely watched by analysts, investors, and policymakers alike. The next few days will be pivotal as the market digests the latest CPI data and its potential impact on future economic conditions.

For ongoing updates, you can follow the latest news on the CPI report through various financial news outlets, including MarketWatch, CNN, and the U.S. Bureau of Labor Statistics.