Current News on Verizon: Key Developments and Insights

Verizon Communications Inc., one of the leading telecommunications companies in the United States, has been making headlines recently with significant developments that could impact its future trajectory. This report summarizes the latest news surrounding Verizon, focusing on its $20 billion acquisition of Frontier Communications, financial performance, and customer growth strategies.

1. Major Acquisition: Verizon to Buy Frontier Communications

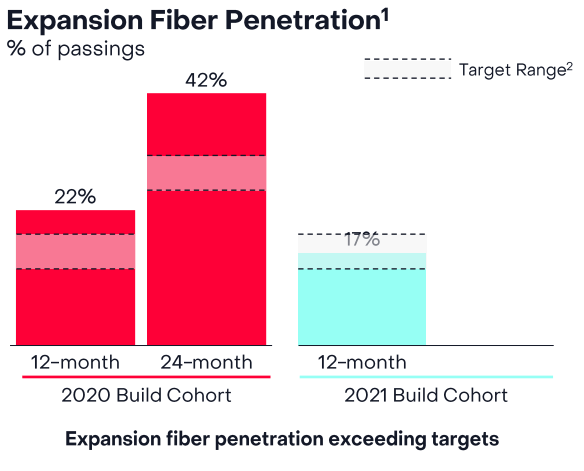

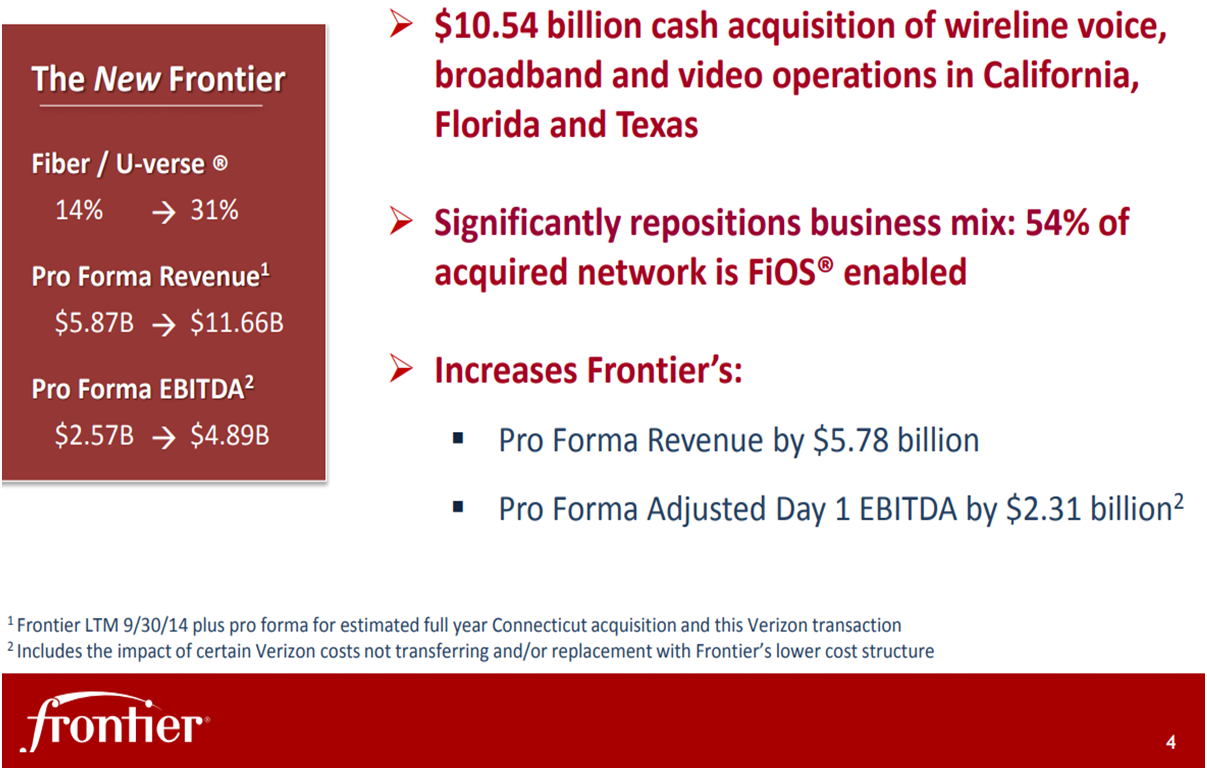

On September 5, 2024, Verizon announced its intention to acquire Frontier Communications in an all-cash deal valued at $20 billion. This strategic move aims to enhance Verizon's fiber network capabilities, which are crucial for meeting the growing demand for high-speed internet services. The acquisition is set to be executed at a price of $38.50 per share, representing a 43.7% premium over Frontier's average share price over the past 90 days.

Implications of the Acquisition

The acquisition is expected to bolster Verizon's position in the competitive telecommunications market, particularly as it seeks to expand its fiber-optic broadband services. This move comes at a time when demand for reliable and fast internet has surged, especially with the increasing reliance on digital services and remote work.

Financial Considerations

While the deal is substantial, analysts suggest that Verizon's current liquidity of $3.9 billion and the ability to refinance Frontier's $11 billion in debt will facilitate the acquisition without jeopardizing Verizon's financial stability. However, some experts warn that this acquisition could pose risks for certain shareholders, particularly if the integration of Frontier does not yield the expected synergies.

2. Financial Performance and Growth

Verizon has been reporting strong financial results, with a notable increase in wireless service revenue. In its recent earnings report, the company highlighted a 0.6% year-over-year increase in sales, totaling $32.8 billion. This growth is attributed to a combination of new customer acquisitions and an increase in service prices.

Dividend Increase

In a positive sign for investors, Verizon has increased its dividend for the 18th consecutive year, maintaining a yield of over 6.5%. This positions Verizon as one of the top dividend stocks in the S&P 500, which typically averages less than 1.5%. The company's commitment to returning value to shareholders remains a key aspect of its financial strategy.

3. Customer Growth and Market Strategy

Verizon has also been focusing on customer acquisition strategies, particularly through flexible mobile plans that cater to a diverse customer base. The company recently launched a $15 per line offer aimed at attracting customers from competitors like Metro, Mint Mobile, and T-Mobile. This promotional strategy is part of Verizon's broader effort to regain market share in a highly competitive environment.

Recent Customer Additions

Verizon reported adding the most new customers in two years, indicating a successful turnaround in its mobile segment. The total wireless service revenue for the quarter reached $19.4 billion, reflecting a 3.2% increase from the previous year. This growth is partly due to the introduction of new data plans and pricing strategies that appeal to both new and existing customers.

4. Future Outlook

As Verizon moves forward with the acquisition of Frontier and continues to enhance its service offerings, the company is well-positioned to capitalize on the growing demand for high-speed internet and mobile services. However, the successful integration of Frontier and the management of its debt will be critical in determining the long-term success of this acquisition.

Market Reactions

The announcement of the acquisition has generated mixed reactions in the market. While some investors are optimistic about the potential for growth, others express concerns about the financial implications and the challenges of integrating Frontier's operations into Verizon's existing framework.

5. Conclusion

Verizon's recent activities, particularly the acquisition of Frontier Communications, highlight its commitment to expanding its fiber network and enhancing its service offerings. With strong financial performance and a focus on customer growth, Verizon is positioning itself to remain a leader in the telecommunications industry. However, the company must navigate the complexities of its acquisition strategy and ensure that it continues to deliver value to its shareholders and customers alike.

For more detailed updates and news releases, you can visit the Verizon Newsroom or follow the latest articles on platforms like CNN and Yahoo Finance.