Current News on Okta Stock: A Comprehensive Overview

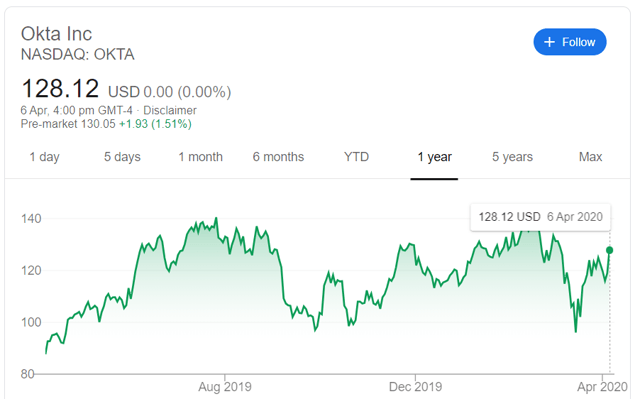

In recent days, Okta, Inc. (NASDAQ: OKTA) has been making headlines due to significant movements in its stock price, particularly following the release of its Q3 earnings report. This report has not only exceeded market expectations but has also provided a glimpse into the company's strategic direction and future prospects. Below is a detailed summary of the latest developments surrounding Okta's stock.

Earnings Report Highlights

On December 3, 2024, Okta reported adjusted earnings per share (EPS) of 67 cents, surpassing the consensus estimate of 58 cents. This strong performance has led to a notable 18% surge in the company's stock price, reflecting investor confidence in Okta's growth trajectory. The company also provided guidance for the upcoming quarter, projecting revenues between $667 million and $669 million, along with an EPS forecast of 73 to 74 cents.

Key Financial Metrics:

- Q3 Adjusted EPS: 67 cents (vs. 58 cents expected)

- Projected Revenue: $667 million to $669 million

- Projected EPS: 73 to 74 cents

This robust performance is indicative of Okta's effective strategy in the identity management sector, where it has been focusing on expanding its product offerings. Notably, 15% of Okta's bookings in the latest quarter came from new products, showcasing the company's commitment to innovation and market leadership.

Market Reactions

Following the earnings announcement, Okta's stock experienced a significant uptick, closing at $97.86, marking a 19.7% increase immediately after the report. This surge is a clear reflection of the market's positive reception to the company's financial results and future guidance.

However, despite the initial gains, there have been fluctuations in the stock price due to broader market trends. For instance, on the same day as the earnings report, Okta's shares fell nearly 1% by midday, influenced by a general downturn in the market, despite a favorable reading from the Job Openings and Labor Turnover Survey (JOLTS).

Analyst Insights

Analysts have been closely monitoring Okta's performance, with some expressing optimism about the company's future. A recent upgrade from Morgan Stanley has been noted, although it coincided with a dip in retail sentiment, which has reached a year-low. This juxtaposition highlights the cautious optimism surrounding Okta's stock, as investors weigh the company's strong fundamentals against broader market uncertainties.

Analyst Commentary:

- Morgan Stanley Upgrade: Reflects confidence in Okta's growth potential.

- Retail Sentiment: Currently at a year-low, indicating cautious investor behavior.

Recent News Articles

Several articles have been published recently that delve deeper into Okta's performance and market position:

As Okta's stock soars on earnings, this stat shows its strategy is paying off - Morningstar discusses how Okta's strategic focus on new products is driving growth.

Okta shares pop 18% on earnings beat, strong guidance - CNBC covers the immediate market reaction to Okta's earnings report and guidance.

Cybersecurity Firm Okta Posts Q3 Earnings, Revenue Beat, Shares Jump - Yahoo Finance highlights the company's strong performance and its implications for future growth.

Okta’s (NASDAQ:OKTA) Q3 Sales Beat Estimates, Stock Jumps 18.9% - The Globe and Mail provides an analysis of Okta's quarterly performance and market outlook.

In summary, Okta's recent earnings report has positioned the company favorably in the eyes of investors, with strong financial results and optimistic guidance contributing to a significant rise in its stock price. However, the broader market dynamics and retail sentiment present challenges that investors should consider. As Okta continues to innovate and expand its product offerings, its ability to maintain this momentum will be crucial for sustaining investor confidence and stock performance in the future.

For ongoing updates and detailed financial information, investors can refer to resources such as Yahoo Finance, MarketWatch, and CNBC.