Current News on Marvell Technology Inc. (MRVL) Stock

As of December 4, 2024, Marvell Technology Inc. (MRVL) has been making headlines due to its recent financial performance and the impact of artificial intelligence (AI) demand on its stock price. Below is a comprehensive overview of the latest developments surrounding MRVL stock, including earnings reports, stock performance, and market analysis.

Recent Earnings Report

Marvell Technology recently reported its third-quarter earnings, which exceeded Wall Street's expectations. The company achieved a 6.9% year-on-year increase in sales, totaling $1.52 billion. This positive performance has led to a significant rise in its stock price, with shares jumping 9% in after-hours trading following the earnings announcement.

Key Financial Figures:

- Loss: Marvell reported a loss of $676.3 million, or 78 cents per share, compared to a loss of $164.3 million, or 19 cents per share, in the same quarter last year.

- Adjusted Earnings: When adjusted for one-time items, the company reported earnings that were more favorable than analysts had anticipated.

The CEO, Matt Murphy, attributed the strong performance to the company's AI silicon programs and robust demand from cloud customers, indicating that the ongoing trend in AI technology is a significant driver for Marvell's growth.

Stock Performance and Market Reaction

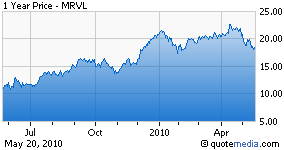

Following the earnings report, MRVL stock has shown remarkable momentum. Over the past month, the stock has increased by 9.99%, and over the last three months, it has surged by 26.70%. Year-to-date, the stock has appreciated by 45.63%, reflecting strong investor confidence and market optimism.

Analyst Ratings

Wall Street analysts have expressed optimism regarding Marvell's future performance. Many analysts have upgraded their ratings, suggesting that the stock is a buy with a potential price target of $93.88, indicating a 17% upside from its current levels.

Market Trends and Future Outlook

The demand for AI technology is expected to continue driving Marvell's growth. The company is well-positioned to capitalize on this trend, given its focus on developing advanced networking chips that cater to the needs of AI applications.

Key Articles and Insights:

Morningstar reported that Marvell's stock is rising due to strong AI demand, but cautioned that this trend may be just as significant as the current performance.

Yahoo Finance highlighted Marvell's strong Q3 numbers and the positive market reaction, emphasizing the company's ability to beat revenue expectations.

MarketWatch discussed the implications of Marvell's performance in the context of AI demand and the company's strategic direction.

Benzinga provided insights into the stock's momentum ahead of the earnings report, noting that analysts see strong bullish trends.

Marvell Technology Inc. is currently experiencing a positive trajectory in its stock performance, driven by strong earnings and the increasing demand for AI technology. Investors are optimistic about the company's future, as reflected in the recent upgrades from analysts and the significant rise in stock price. As the market continues to evolve, Marvell's strategic focus on AI and networking solutions positions it well for sustained growth in the coming quarters.

For more detailed information and updates, you can follow the latest news on MRVL stock through various financial news platforms such as Yahoo Finance, MarketWatch, and Seeking Alpha.