Current News for Currencies: A Comprehensive Overview

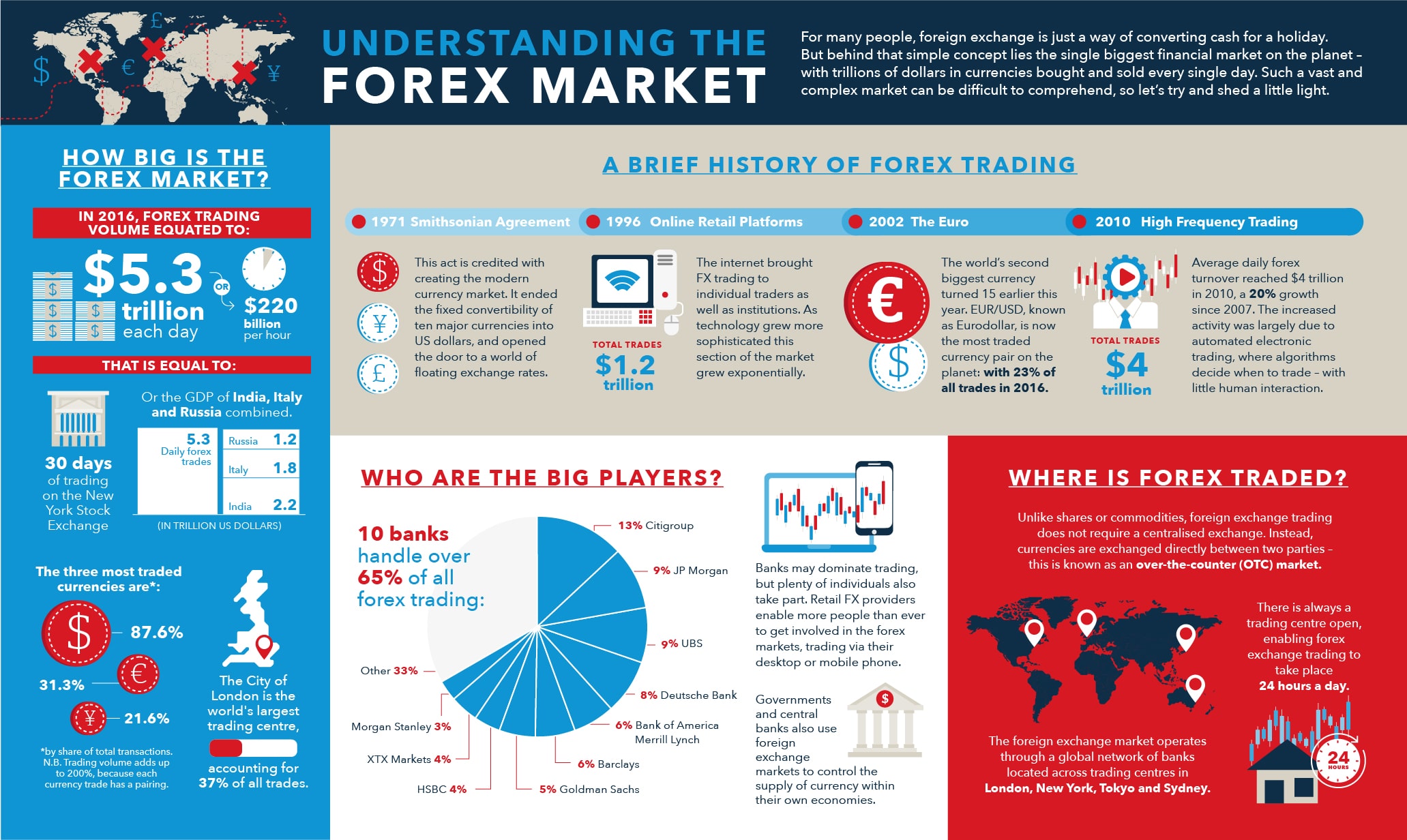

In the ever-evolving landscape of currency markets, recent developments have captured the attention of investors, analysts, and policymakers alike. With a staggering 3.88 million estimated matches for the query "current news for currencies," it is evident that the financial world is abuzz with activity. This report synthesizes the latest headlines and insights from various reputable sources, providing a comprehensive overview of the current state of currency markets.

Key Headlines and Developments

1. U.S. Treasury's Stance on Currency Manipulation

On December 11, 2024, U.S. Treasury Secretary Janet Yellen stated that the U.S. would "react strongly" to any attempts by countries to manipulate their currencies for competitive advantage. This statement came in light of the Treasury's latest semi-annual currency report, which found no manipulation from major trading partners but kept China on a monitoring list due to its significant trade surplus with the U.S. and lack of transparency in its currency practices. Read more here.

2. Emerging Market Currencies Face Challenges

Emerging-market currencies have experienced a second consecutive week of losses, primarily driven by the Brazilian real. As traders prepare for the Federal Reserve's final meeting of the year, concerns about the U.S. dollar's strength have led to a sell-off in these currencies. Read the full article.

3. Dollar's Surge Impacts Emerging Markets

The U.S. dollar has surged, resulting in the most significant decline in emerging market currencies in two years. Analysts attribute this to a combination of factors, including a "confluence of bad news" affecting these markets. The implications of this trend are critical for investors and policymakers alike. Explore the details.

4. Bitcoin's Potential as a Reserve Currency

As discussions around digital currencies continue, a recent article poses the question: "Is Bitcoin the future of global reserve currencies?" The piece explores the criteria that reserve currencies must meet and assesses whether Bitcoin can rise to this status amid evolving financial landscapes. Read more about this topic.

5. Syrian Pound Strengthens Post-Assad

In a surprising turn of events, the Syrian pound has strengthened against the U.S. dollar by at least 20% following the fall of the Assad government. This shift is attributed to an influx of Syrians from neighboring countries and the easing of strict controls on foreign currency trade. Learn more here.

6. Canadian Dollar Rallies on Central Bank Guidance

The Canadian dollar has outperformed its G10 counterparts, buoyed by the Bank of Canada's recent shift to a more hawkish stance on interest rates. This development has significant implications for the currency's future trajectory. Find out more.

Notable Sources for Currency News

For those seeking in-depth analysis and real-time updates on currency markets, several reputable sources provide valuable insights:

- Reuters: Offers comprehensive coverage of currency market performance and breaking news.

- CNBC: Provides updates on international currency rates and market trends.

- The Wall Street Journal: Features the latest news and analysis on currency and foreign exchange markets.

- Markets Insider: Delivers live exchange rates and currency market news.

- Bloomberg: Offers current exchange rates and insights into foreign currency trading.

The currency markets are currently experiencing significant fluctuations influenced by various global economic factors, including central bank policies, geopolitical events, and emerging trends in digital currencies. As the U.S. dollar continues to assert its dominance, emerging market currencies face mounting pressures, while discussions around the potential of cryptocurrencies like Bitcoin as reserve assets gain traction.

Investors and stakeholders must remain vigilant and informed, leveraging reliable news sources to navigate this complex and dynamic financial landscape. The coming weeks will be crucial as the Federal Reserve meets and as global economic conditions evolve, potentially reshaping the currency market's future.