Current News on MicroStrategy Incorporated (MSTR) Stock

MicroStrategy Incorporated (MSTR) has been making headlines recently, particularly due to its financial performance, stock split, and ambitious plans in the cryptocurrency space. Below is a comprehensive overview of the latest developments surrounding MSTR stock.

Financial Performance

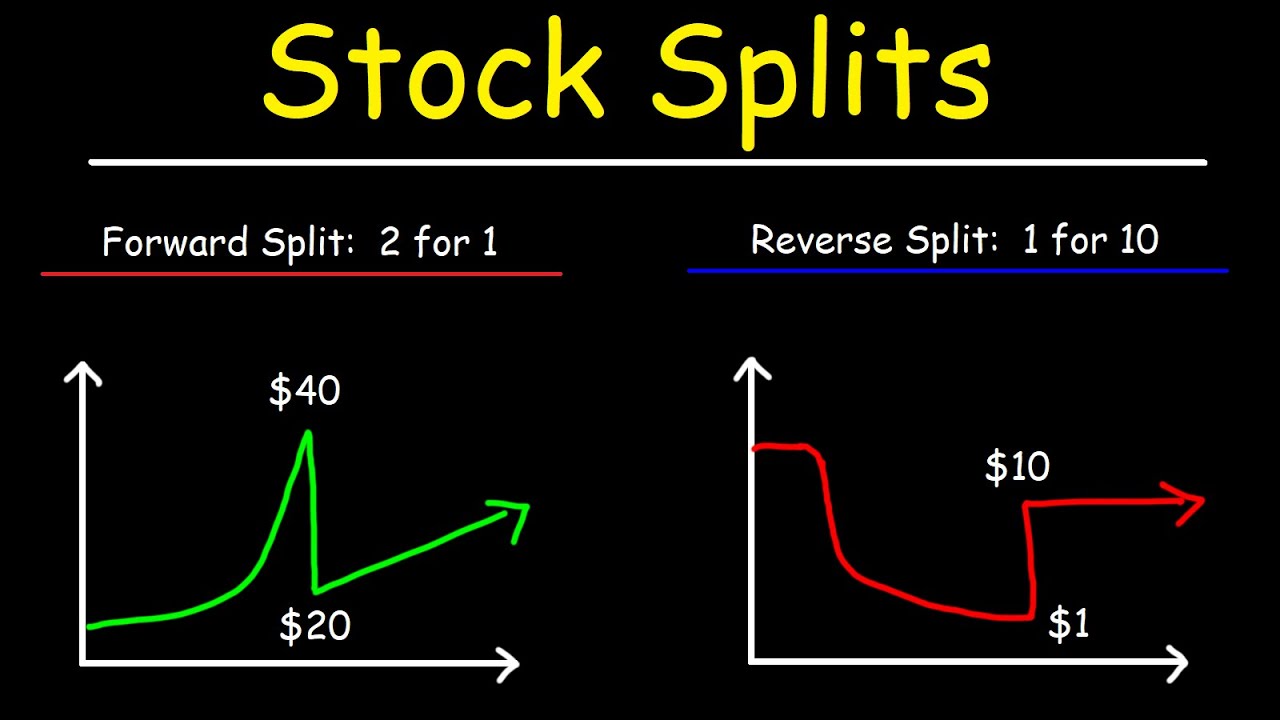

MicroStrategy has reported a 7% revenue decline as it transitions to a cloud-based business model. Despite this setback, the company has maintained a robust position in the cryptocurrency market, particularly with its strong Bitcoin holdings. The firm has also announced a 10-for-1 stock split, which is expected to make its shares more accessible to a broader range of investors.

Key Financial Highlights:

- Revenue Decline: 7% amid cloud transition.

- Bitcoin Holdings: Strong and stable, contributing to investor confidence.

- Stock Split: A 10-for-1 split aimed at increasing liquidity and attracting more investors.

For more detailed financial information, you can visit Yahoo Finance.

Stock Split Announcement

The announcement of the 10-for-1 stock split has been a significant point of interest for investors. This move is seen as a strategy to enhance the stock's liquidity and attract a wider investor base. The split is particularly noteworthy as it comes at a time when MicroStrategy's share price was hovering around $1,300.

Implications of the Stock Split:

- Increased Accessibility: Lowering the price per share makes it easier for retail investors to buy into the stock.

- Market Sentiment: Historically, stock splits can lead to increased interest and trading volume.

For further insights on the stock split, you can read more on The Motley Fool.

Recent Stock Performance

As of October 14, 2024, MSTR stock has seen a modest uptick, closing at $212.59, which represents a 15.95% increase from the previous close of $183.34. This rise in stock price is attributed to several factors, including the company's strategic moves and market conditions.

Notable Stock Movements:

- Current Price: $212.59

- Previous Close: $183.34

- Percentage Increase: 15.95%

For real-time updates on stock prices, you can check MarketWatch.

Ambitious Plans in Cryptocurrency

MicroStrategy's founder, Michael Saylor, has been vocal about the company's plans to become a Bitcoin bank. This ambition has led to a surge in MSTR stock, reaching an all-time high (ATH). The company aims for a $1 trillion valuation, positioning itself as a leader in the cryptocurrency banking sector.

Key Developments:

- Bitcoin Bank Plans: Aiming to become a significant player in the cryptocurrency banking space.

- ATH Stock Price: The stock has reached new heights, reflecting investor optimism about the company's future.

For more on this ambitious plan, you can read articles from AMBCrypto and Blockonomi.

Market Sentiment and Analyst Ratings

The market sentiment surrounding MSTR stock remains largely positive, with analysts rating it as a "Strong Buy." The average price target for the stock is set at $202.25, indicating a slight decrease from its current price but still reflecting confidence in the company's long-term prospects.

Analyst Insights:

- Average Rating: Strong Buy

- 12-Month Price Target: $202.25

For detailed analysis and ratings, you can visit Seeking Alpha.

MicroStrategy Incorporated (MSTR) is currently at a pivotal moment in its corporate journey. With a strategic focus on Bitcoin, a recent stock split, and a commitment to transitioning to a cloud-based business model, the company is positioning itself for future growth. Investors are closely watching these developments, as they could significantly impact the stock's performance in the coming months.

For ongoing updates and detailed financial information, you can explore various financial news platforms such as Google Finance and The Wall Street Journal.

Additional Resources

Stay informed about MicroStrategy's developments as they unfold, and consider how these factors may influence your investment decisions.