Tax Extension Deadline 2024: Key Information and Updates

As the October 15, 2024 tax extension deadline approaches, the Internal Revenue Service (IRS) is reminding taxpayers of the importance of filing their federal income tax returns on or before this date. This deadline is crucial for those who requested an extension for the 2023 tax year. Here’s a comprehensive overview of the current news and essential details regarding the tax extension deadline.

IRS Reminders and Updates

On October 7, 2024, the IRS issued a reminder encouraging taxpayers to file their returns to avoid potential late filing penalties. The agency highlighted that most taxpayers who requested an extension must file by Tuesday, October 15, to avoid penalties. The IRS has also urged individuals to file electronically, which can streamline the process and reduce errors.

Key Points from IRS Announcements:

- Deadline: Taxpayers must file their 2023 federal income tax returns by October 15, 2024.

- Filing Method: The IRS recommends electronic filing to minimize mistakes and expedite processing.

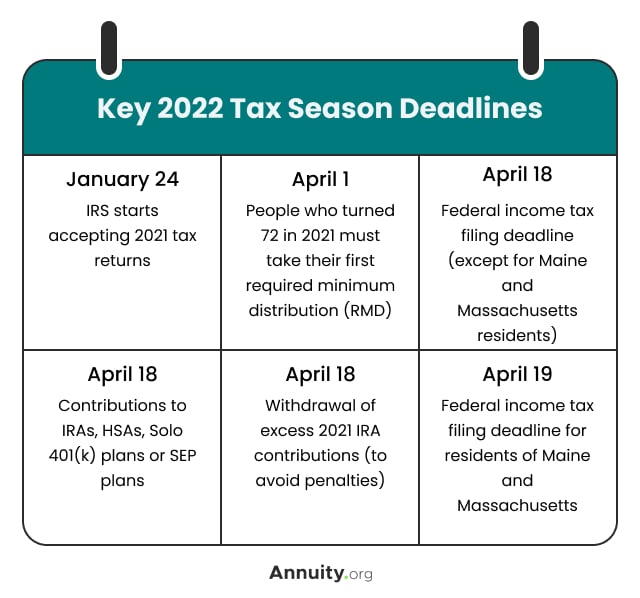

- Extensions: An extension to file does not extend the time to pay any taxes owed. Taxpayers are still responsible for any payments due by the original deadline of April 15, 2024.

For more detailed information, taxpayers can refer to the IRS's official announcements, including IRS Tax Tip 2024-81 published on October 3, 2024.

Consequences of Missing the Deadline

Failing to file by the October 15 deadline can lead to significant financial repercussions. Taxpayers may incur late payment penalties, which can accumulate interest over time. According to a report from NerdWallet, missing this deadline could result in additional fees and complications, especially for those who owe taxes or have unreported foreign accounts.

Potential Penalties Include:

- Late Filing Penalties: These can be substantial, especially if taxes are owed.

- Interest Accrual: Interest on unpaid taxes continues to accumulate until the balance is paid in full.

- Installment Plans: The IRS offers installment plans for those who cannot pay their taxes in full by the deadline.

Special Considerations for Disaster Areas

The IRS has extended the tax deadline for individuals and businesses in areas affected by hurricanes and other disasters. Taxpayers in these regions may have additional time to file their returns without incurring penalties. This extension applies to those in states impacted by recent severe weather events, including Florida, Georgia, and North Carolina.

Resources for Affected Taxpayers:

- The IRS has provided a map showing areas where tax deadlines have been extended due to disasters.

- Taxpayers in these areas should check the IRS website for specific guidance and updates regarding their filing requirements.

Filing Extensions and Free File Options

For those who need more time, the IRS offers a Free File option, allowing taxpayers to request an extension easily. This extension grants an additional six months to file, pushing the deadline to October 15. However, it is crucial to remember that this extension only applies to filing, not to payment.

How to File for an Extension:

- Complete Form 4868: This form can be filed electronically or via mail.

- No Payment Required: If you do not owe any taxes, you can file for an extension without making a payment.

- Deadline for Extension: The extension request must be submitted by the original filing deadline, which is April 15.

For more information on how to file for an extension, taxpayers can visit the IRS's Free File page.

Recent Articles and Resources

Several reputable sources have published articles discussing the upcoming tax extension deadline and its implications:

- Forbes: An article titled "Don’t Miss The Oct. 15 Tax Extension Deadline" emphasizes the importance of meeting the deadline to avoid penalties.

- USA Today: Reports on how the October 15 tax deadline has been adjusted for states affected by hurricanes, providing essential updates for impacted taxpayers.

- Newsweek: Discusses the IRS's map showing extended deadlines for various states, ensuring taxpayers are aware of their specific filing requirements.

As the October 15, 2024 deadline approaches, it is imperative for taxpayers to stay informed and take action to ensure compliance with IRS regulations. Filing on time can prevent unnecessary penalties and complications. Taxpayers should utilize available resources, including the IRS website and reputable financial news outlets, to navigate the filing process effectively.

For further details, taxpayers can visit the IRS's official website or consult financial advisors to ensure they meet their obligations and avoid any potential issues related to their tax filings.